MediaCom’s Head of Systems Intelligence, Jane Christian, uses the new Demand Generator to explore the impact of cutting spend levels on the optimal media mix for a brand.

I’ve spent the last 19 years crafting a career in helping to advise clients on which media channels are most effective to hit their business objectives. The questions I’m getting asked time and time again at the moment are how much have tried and tested rules changed and what does optimal look like in the current climate given most advertisers are faced with smaller budgets, both currently and for the foreseeable future. Specifically, how many and which channels should be used?

Thinkbox’s Demand Generation launched in November 2019 and was the biggest industry evaluation of channel effectiveness to date. Fuelled by data from MediaCom, Wavemaker and Gain Theory, the study culminated in the launch of the Demand Generator, a web app designed to provide advertisers with the optimal media plan, bespoke for their brand.

The Demand Generator has been updated based on the feedback received from the first version. It now offers advertisers increased functionality when running scenarios. This additional functionality provides us with a unique and scaled view of the impact of cutting spend levels on the optimal media mix for a brand.

Some elephant in the room caveats before we go any further. The study was conducted in the pre-COVID 19 period, when the world was very different. The picture is different in every sector, but the following are significant things that have changed since COVID:

- Level and nature of demand in a category

- Media consumption

- Changing budgets

- Cost of media

- Ability to make copy

- Future outlook for a category

These known changes aside, the data from the Demand Generator still provides valuable principles that can help when budgets are being put under pressure.

The key watch out is that a layer of pragmatism and some manual adjustments are required to attempt to controls for the factors above. For example, if demand in a sector has fallen by 50%, undoubtedly the immediate ROI will fall when advertising in this sector. Only time will tell by exactly how much, but assuming a matching 50% may be sensible. There may be a stronger longer-term sustained effect, depending on the copy used, but again, only time will tell exactly how this will affect overall ROI.

Getting back to our questions: how many channels should be employed when budgets are cut? Assuming here that production costs are also coming under pressure, the answer to this in my view should be mainly based on how much good quality copy an advertiser can afford to produce and removing investment from channels where investment would drop below a sensible minimum threshold

For advertisers who have a full set of copy available

For some advertisers, they may consider using existing copy. Or they may still find it cost effective in current times to produce copy for a full range of channels (naturally excluding those which are not currently viable). For advertisers in these situations, using almost a full range of channels is still possible.

The Demand Generator can be used to run reduced budget scenarios. It provides brands with an optimal channel mix for a given budget, based on a number of characteristics of the brand, such as its sector, size, proportion of sales sold online.

The new version now also allows advertisers to deselect any channels they wish not to use. Using this new functionality, we can scenario test the impact of cutting spend on a given channel.

After running a number of scenarios, we see that, if an advertiser can afford to make copy for all channels, when budgets are cut the optimal media mix changes only slightly, with the budget cut being taken off all channels. This may leave some channels with a very small budget. A pragmatic view may be to manually remove these channels from the plan as very small spend levels may not cut through sufficiently.

There will be some categories where, in the current climate, further manual changes will be needed. For example, in some categories where demand has fallen there may be less capacity for investment in Generic Search.

For advertisers who cannot afford to make copy for all channels

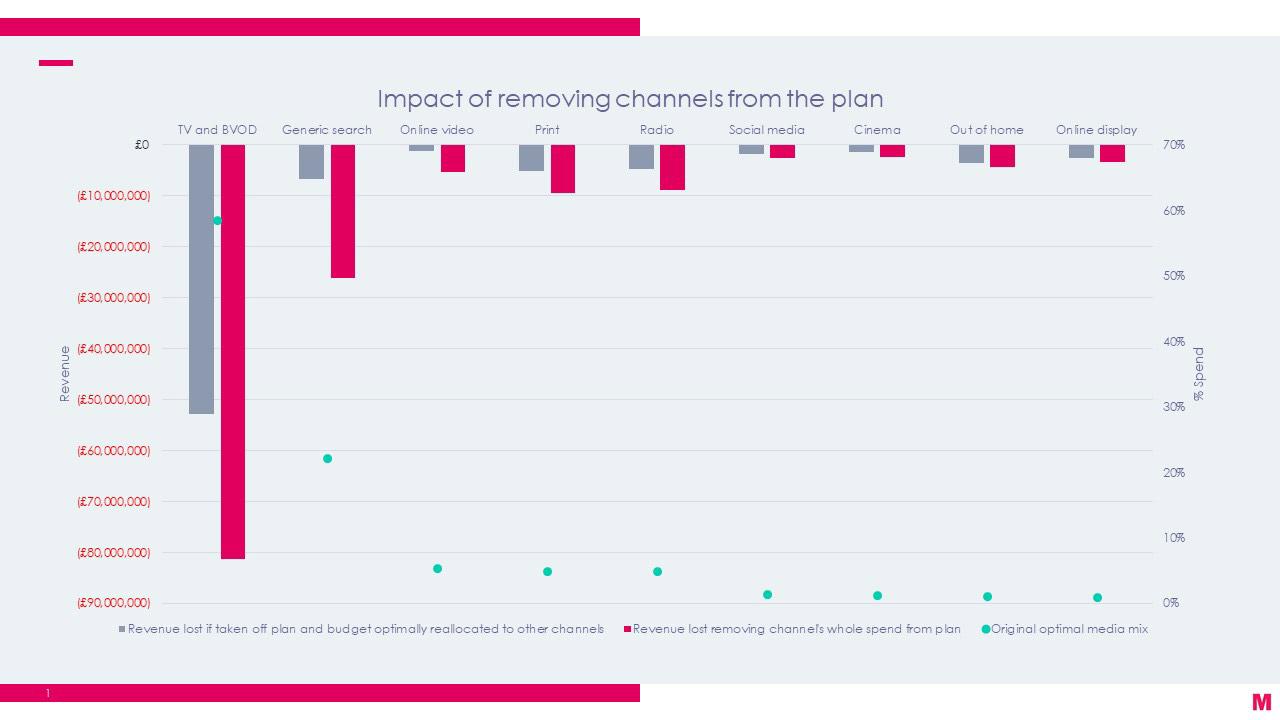

Using the Demand Generator, we can take away each channel from the mix and look at the loss of revenue. Let’s take the example of a Finance brand with a starting budget of £30m that wants to make a considerable reduction:

- Where a channel's budget is taken off the plan and not redistributed.

- Where a channel's budget is taken off the plan and re-optimised across the remaining channels.

As you can see, removing the bigger channels has a huge impact on what can be delivered.

Removing TV and Broadcaster VOD full stop from the plan (red bar) creates a loss of £81.3m. Removing TV and Broadcaster VOD but reallocating its budget across the other channels (grey bar) creates a loss of revenue of £52.8m.

The example shows that the other channels cannot absorb TV’s budget efficiently as they are approaching saturation. This is important as even though TV’s creative costs tend to be higher than other channels, the scale it delivers more than justifies this up-front cost. Simply reallocating this budget to other channels won’t be able to recoup the lost revenue generated by TV.

For Generic Search, removing it from the plan full stop creates a loss of revenue of £26.1m. Removing Generic Search but reallocating its budget across the other channels creates a loss of revenue of £6.7m. This is a smaller loss than for removing TV as the Generic Search budget is lower.

What does this mean for advertisers?

They will need to make their own conclusions on which channels to make copy for, but removing the big channels from the plan will create a big loss in revenue – a loss that the other channels will not necessarily be able to absorb efficiently.

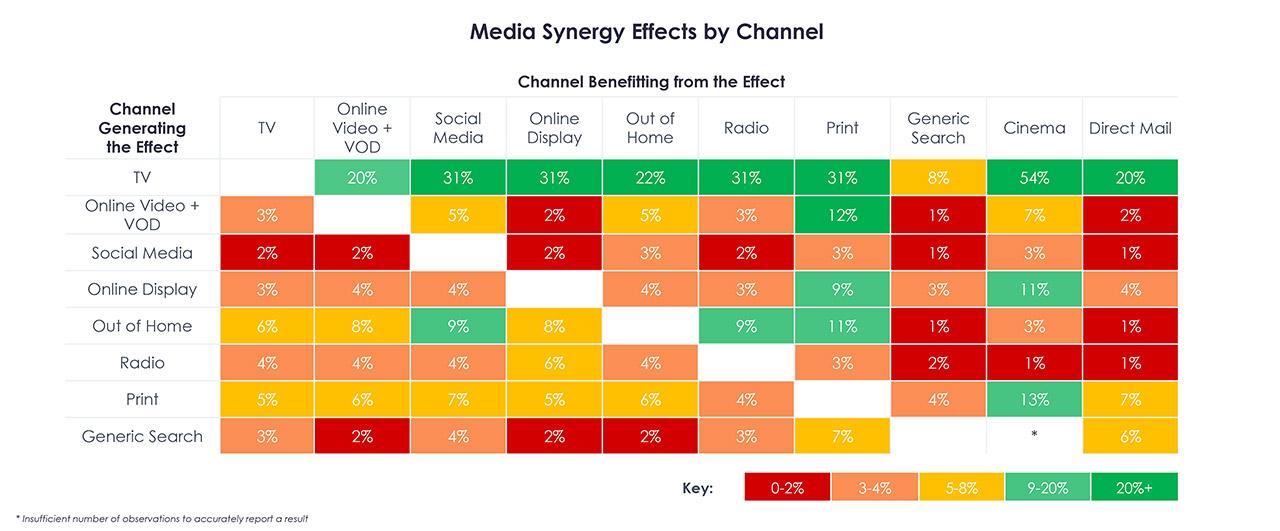

There are some downsides to reducing the number of channels used. Using fewer channels may limit the reach of the media plan, meaning not all of our target audience is accessible.

Another downside relates to the loss of media synergies. One of the most interesting charts from Demand Generation was the media synergy table below. This was our first scaled look at how one channel affects the efficiency of another, when they are run concurrently.

All channels boost the effectiveness of other channels to some extent, therefore having more channels on the plan derives the maximum synergy effects. Conversely, taking channels off the plan will reduce these benefits.

In summary

If brands are faced with budget cuts as they are right now, the number of channels to leave on the plan should be determined by how much good quality copy an advertiser can afford to produce, with investment removed from channels where it would drop below a sensible minimum threshold.

For those advertisers who can afford to make copy across a full range of channels, the Demand Generator suggests cutting spend across most channels. Those left with very low levels of spend may be dropped from the plan.

For those advertisers who cannot afford to make copy for all channels, they will need to make their own personal calculation on which channels they can afford to make copy for.

What we know is that removing the big channels from the plan will create a big loss in revenue that the remaining channels will not necessarily be able to absorb efficiently. Perhaps the answer here therefore it to stick with the ‘big bankers’, so that the plan still drives the scale of response that advertisers need.

Thinkbox

Thinkbox