In Brief

The increase in ecommerce is arguably the biggest business behavioural shift caused by the pandemic, creating a surge in new online businesses disrupting every conceivable category.

These new businesses are hugely dependent on marketing for sales and growth. Unsurprisingly, the entry point into advertising for the vast majority of online businesses focuses on online channels - using search, social media, and online video.

But that only nourishes them for so long. Eventually, most hit a ceiling. When they do, it’s time to move beyond the relative safety of online media and easily identifiable online customer journeys. TV advertising is often a crucial part of this next phase in their marketing-driven growth.

This study, based on advertisers that have successfully grown their volume of web traffic through TV advertising, provides online businesses with their first-ever TV playbook, a specialist guide to help unravel and navigate what can be a daunting and confusing journey. The analysis tackles the roles TV advertising plays, how this varies for different businesses and marketing objectives, and how the powerful combination of TV and search work together.

Methodology

- Qualitative interviews with industry experts X 7

- Econometric analysis of 10 online businesses that have successfully grown web traffic through TV advertising

Key findings

Three signs it’s time for TV

1. A clever new product - when understanding your proposition makes people more likely to buy

- TV is a useful medium to educate consumers at scale, directing engaged consumers who understand the product and are more likely to purchase.

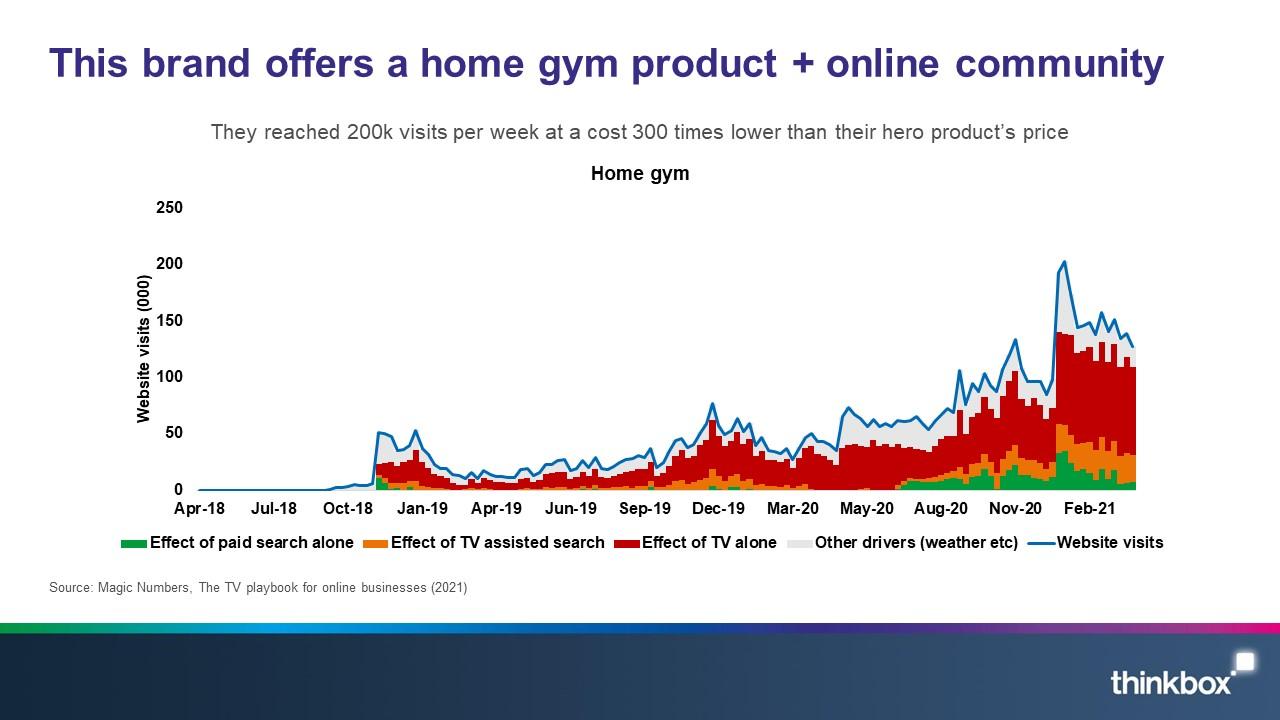

- A home gym equipment business, with a novel proposition, reached 200k visits per week at a cost per visit 300 times lower than their hero product’s price through their TV campaign.

2. When you need to scale fast

- A second-hand online car dealership reached 0.5m visits per week after scaling up TV investment.

3. When you run out of efficient online buys

- Growth for these brands tended to come to a halt when additional spend in their usual marketing mix no longer delivered as much incremental returns and so need to review their media mix to continue to unlock growth.

- Modelling revealed that a dieting brand had a peak weekly web traffic of 111,000 visitors and an average of 23,300 prior to trialing TV. Following their TV launch, the peak rose to 378,000 visitors and the average increased to 99,000 visitors.

The effects of TV on your business

An immediate response visible in your dashboards

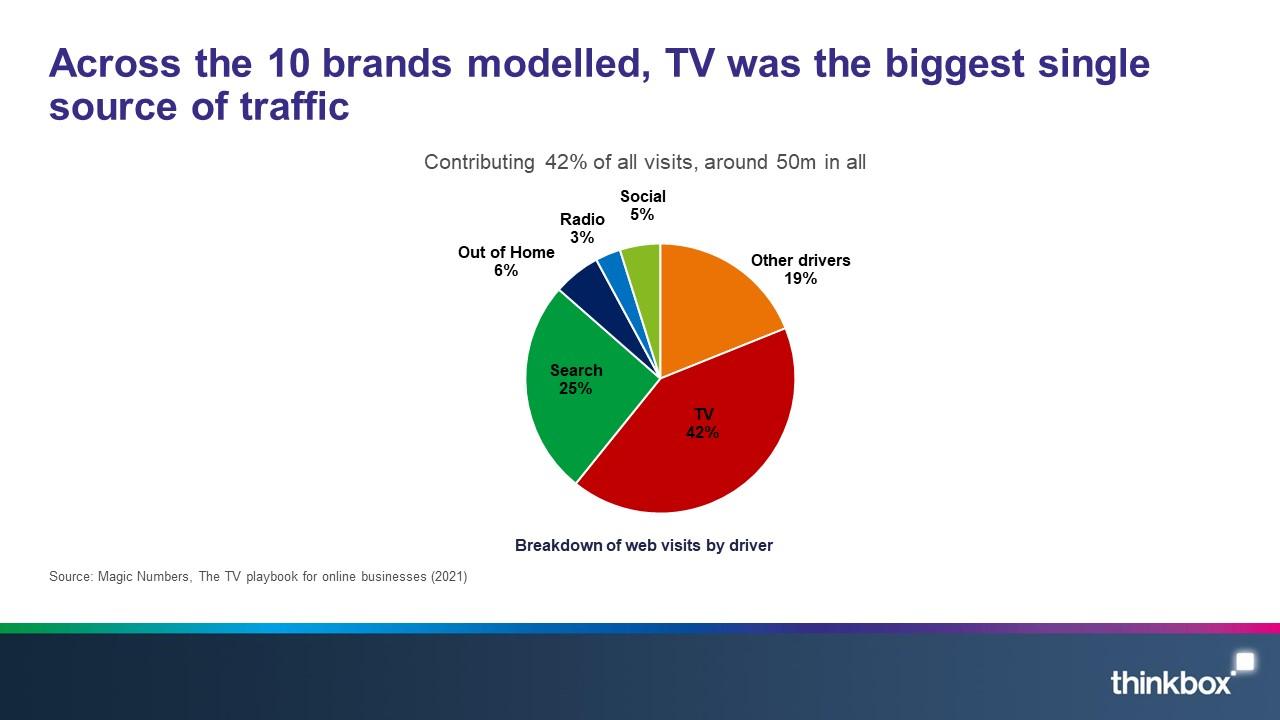

- Individual brand data consistently shows a clear relationship between TV activity and web traffic. Across the 10 brands modelled, TV drove 42% of all visits, 50 million in total.

A big effect at a cost per visit comparable to that of search advertising

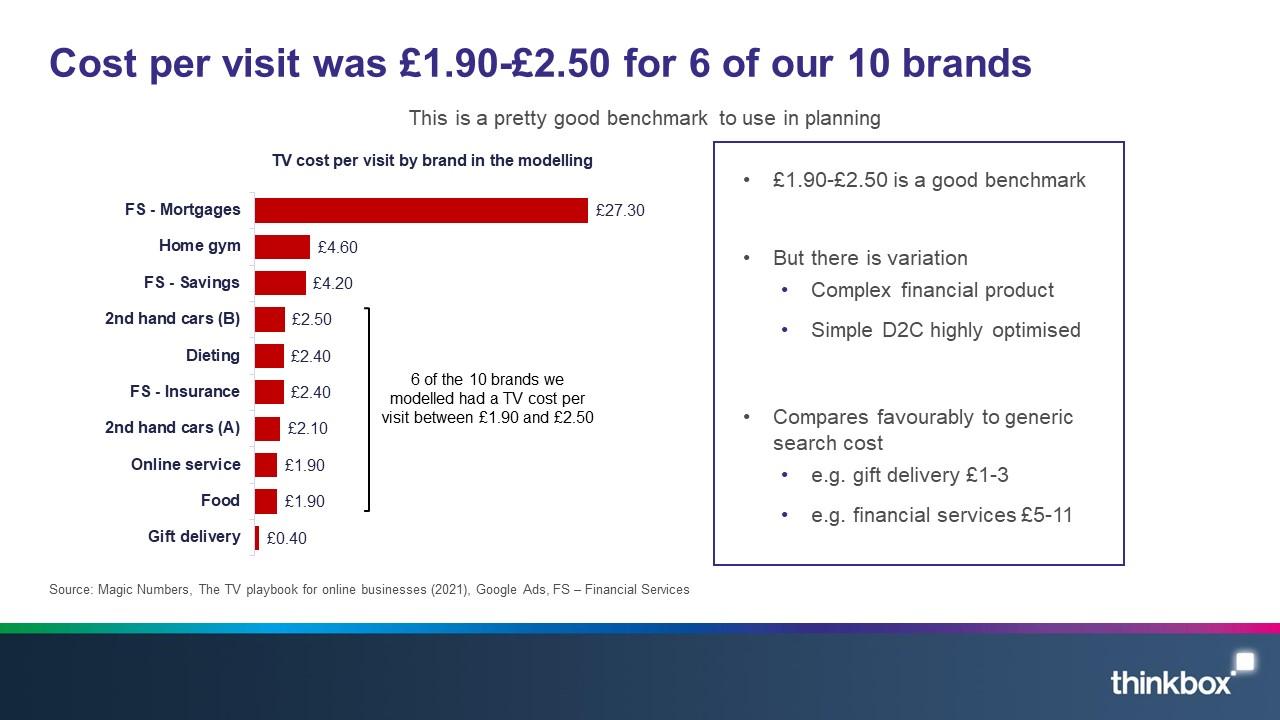

- Across the 10 brands analysed, TV drove 50 million visits at an average cost per visit of £2.11.

- 6 of the 10 brands we modelled had a TV cost per visit between £1.90 and £2.50. In comparison to generic search where the costs are hugely variable but a typical cost per click (visit) in gift delivery is £1-3, and in financial services £5-11.

Lasting ad effects that grow base sales

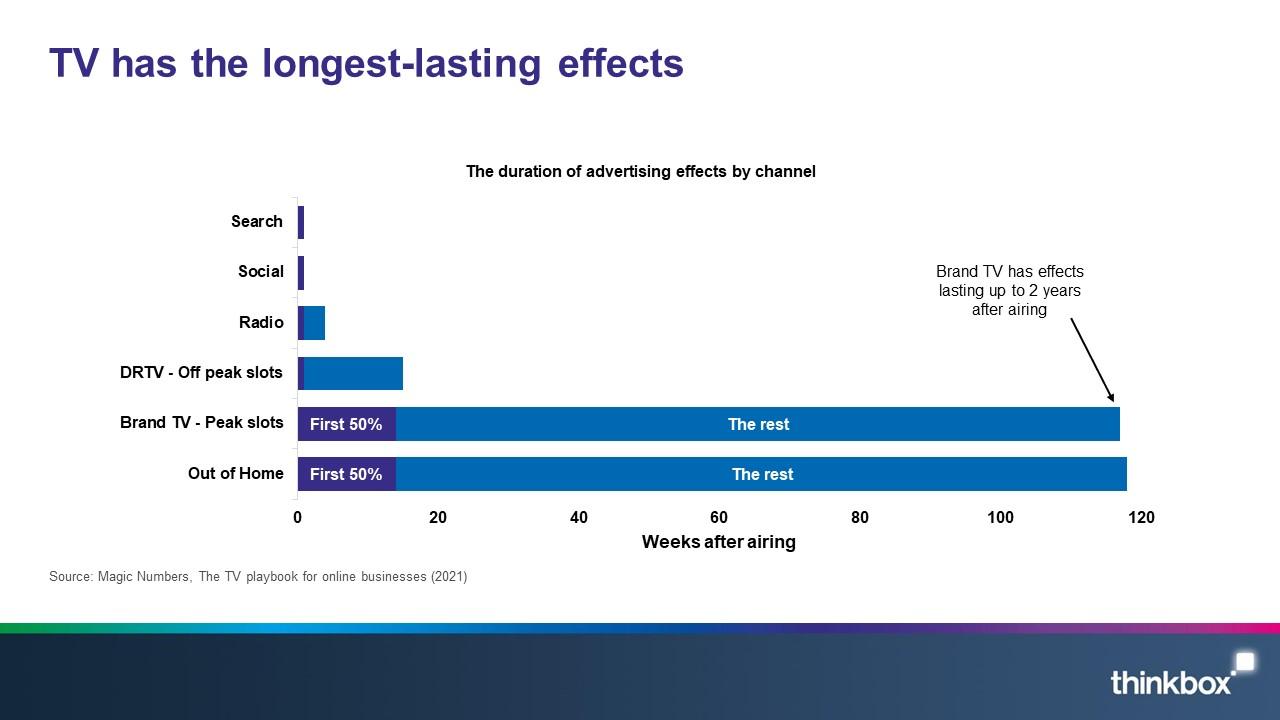

- TV is also effective at brand building. Brand focused TV advertising alongside Out of Home advertising was shown through the modelling to have the longest-lasting effects, delivering 50% of sales in the first 14 weeks following activity and the other 50% in the remaining two years after airing.

TV drives cost-effective search

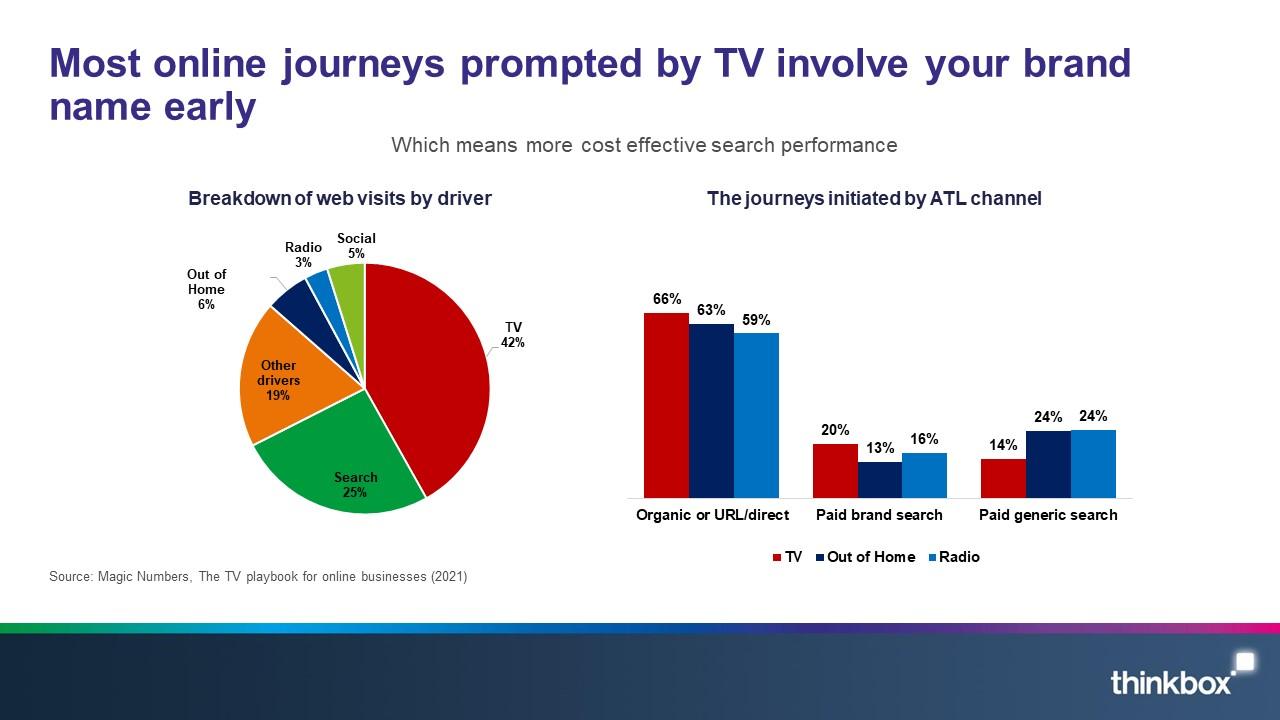

TV drives cost effective web visits because it prompts people to look for your brand not the category

- Of the web visits initiated by TV, 66% were direct/URL or organic search visits (which carry zero additional cost), 20% were paid for brand search clicks (which carry a small search cost), and 14% were for paid generic searches (that carry a high search cost).

A 2-step approach to TV that works

The following guidance is based on the findings from the expert interviews and the approach to TV used by the 10 brands in the study.

Start with acquisition/response focused TV that allows test and learn

- Most online businesses should first establish the business case for TV advertising through an acquisition/response focused campaign:

- Target an immediate response (call to action focussed creative, airtime targeting the audience most likely to buy).

- Lower priced airtime (no peak on larger rating channels).

The next stage of growth will likely require a move away from an efficiency-based strategy.

- Depending on your brands circumstances, there is a right way to shift into brand focussed advertising.

- Working with both a media and creative agency will benefit businesses looking for the next stage of growth.

In depth

Background

According to most econometric meta-studies, two channels stand out as the fundamental drivers of advertising generated business growth; TV and paid search.

Search, social and online display provides the entry point into advertising for the vast majority of ecommerce businesses. These online media provide a familiar route to increased demand, however their effects are limited when it comes to attracting those who aren’t already in market.

For businesses looking to scale up to the next level, entering the world of TV advertising is a crucial (and often daunting) step.

As these businesses were born and raised in an online world of instant gratification and return path data, the journey into TV can seem overwhelming. Creative costs, lead times and the inability to easily gather data on the direct impact of TV advertising are among the barriers to entry.

This study aims to provide guidance to small and medium sized ecommerce businesses who are looking to turbo-charge their growth, by addressing these challenges and taking advantage of the many benefits of the synergy between TV advertising and search activity.

Methodology

Magic Numbers conducted qualitative interviews with marketers that work on online brands week in and week out as part of the first stage of this study. This included five senior client side marketers; Xabi Izaguirre (Parcelmonkey), Cheryl Calverley (Eve Sleep), Chris Seigal (Harry’s), Abba Newberry (Habito) and Lucas Bergmans (Cazoo). Media specialists Tom Beardmore (Chamber) and Simon Wilden (Goodstuff) were also interviewed. Drawing on their knowledge, these experts were asked about their experience scaling ecommerce businesses, their decision to use broad reach media including TV, and the effects of going live on TV. Search also played a role in the discussions addressing how they use it, how it works and how it works alongside TV advertising.

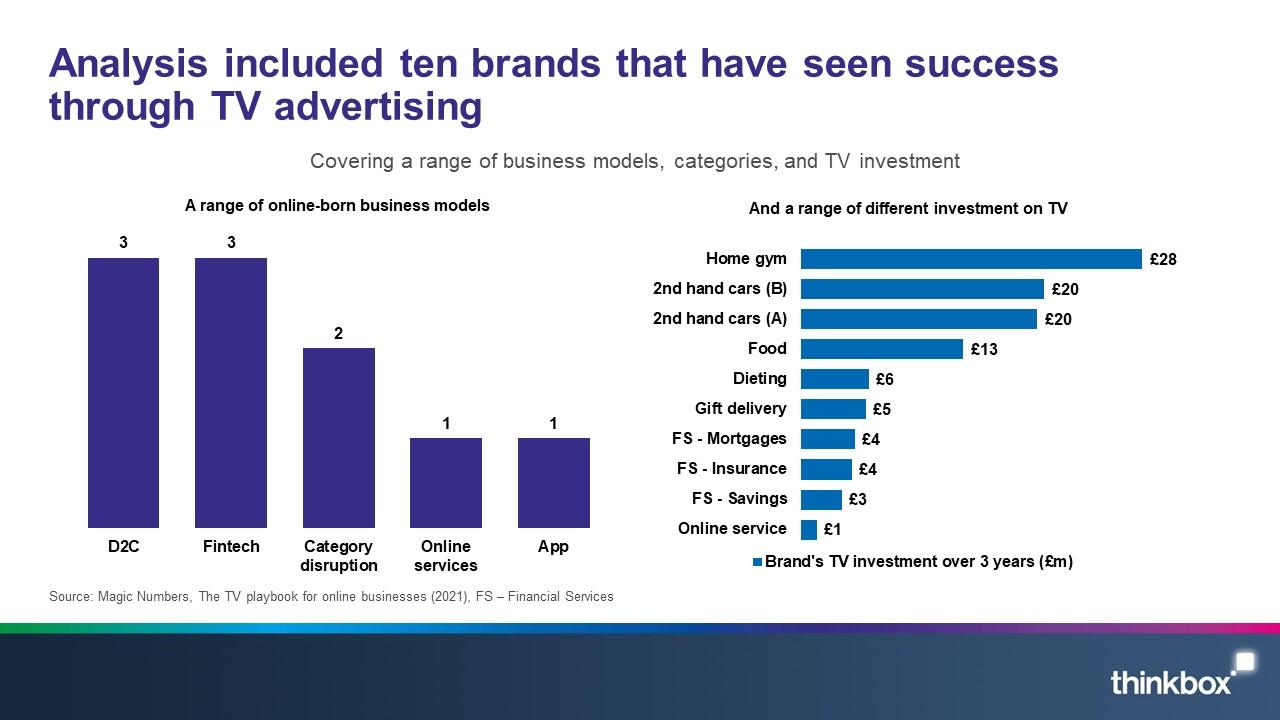

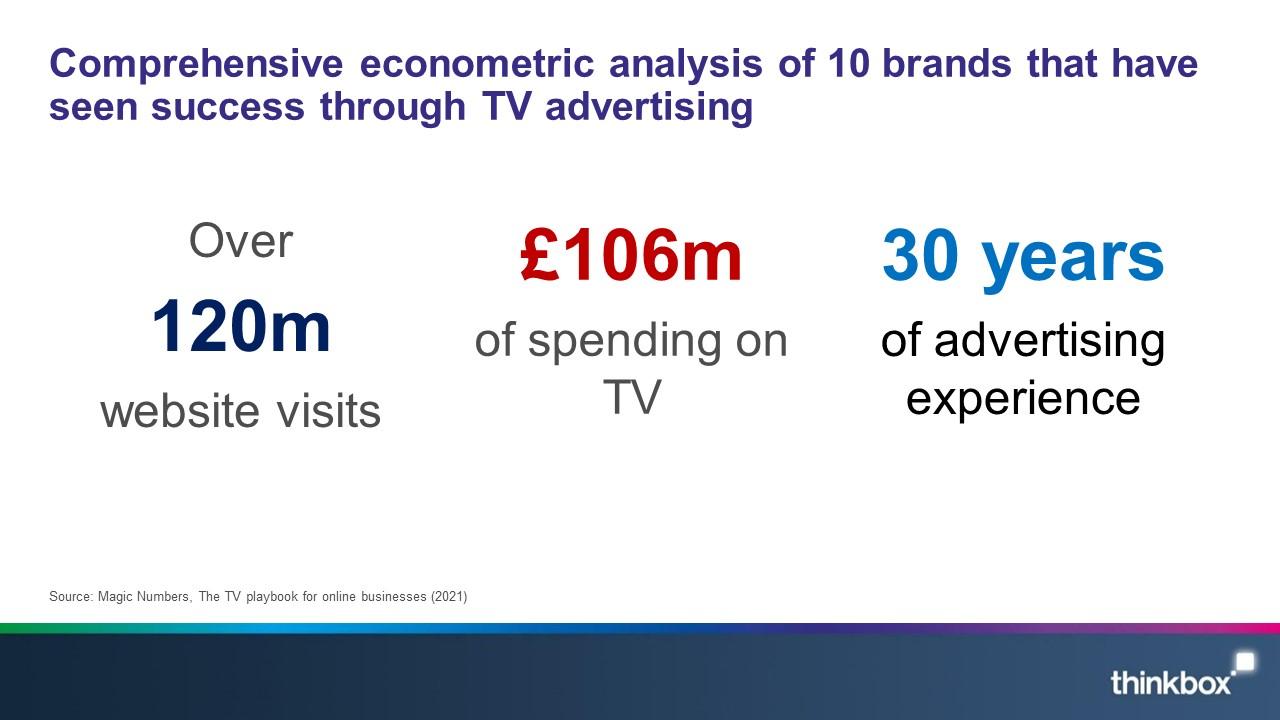

Additionally, Magic Numbers conducted econometric analysis on 10 online businesses that have successfully used TV to drive growth in recent years, with modelling spanning three years ending March 2021. Brands were selected from a range of categories including (but not limited to) financial services, gift delivery and second-hand cars. Brands were hand-picked based on those that advertised on TV and are driving results. The analysis evaluated £106m of TV spend, over 120m website visits and 30 years of advertising experience across the 10 brands. They are part of the phenomenon that we have witnessed in 2021 – the boom of online-born businesses and their growing investment in TV.

With the research grounded in econometrics, the modelling occurred in two stages. The first addressed the source of web visits where multiple factors contributed to visits. Analysis looked at the contributions by external non media factors (including the economy, weather, the impact of COVID and competitor activity), TV ads (peak, non-peak and on demand), paid brand search, paid generic search as well as other media utilised by these advertisers.

The second phase of modelling establishes how TV and other elements drive different types of online journeys. This stage specifically explored website visits that were ‘assisted by’ paid search to investigate what prompts people to click on a brand or generic paid search ad. Evaluating the type of online journey TV prompts was important as journeys that involve paid brand search are cheaper than journeys that involve paid generic search, which are the most expensive of all.

All modelling was conducted using data that was available to buy or access through open data sources; Similarweb was used for the estimates of web traffic and paid for search activity, Nielsen AdIntel was used to model investment into linear TV, Radio and Out of Home. The other data sources used in the modelling were BARB, Google mobility, ONS, Google trends, CASS, SMMT, Investopedia, news articles.

Due to the limited data available from walled gardens such as Facebook and YouTube, although it was possible to determine what traffic was derived from a social platform, it wasn’t possible to model a cost per response. Magic Numbers also looked to investigate the role of BVOD, but were unable to attain a three year set of data that would be required for this specific model.

Findings

Magic Numbers conducted econometric analysis on 10 online businesses that have successfully used TV to drive growth in recent years. The analysis identified four areas of guidance for online born businesses that will help them grow their business through TV advertising.

1. Three signs it’s time for TV

A clever new product - when understanding your proposition makes people more likely to buy

Unless you land two or three points that explain our product, you're not really going to get people to come to the website with the right level of intent in the first place. And it's hard to deliver those three messages outside of TV

Lucas BergmansGroup Brand Director, Cazoo

TV is the perfect medium for brands to educate consumers and drive website visits simultaneously - especially if the product is clever, new, or difficult to understand. This subsequently has a positive impact on conversion rate by bringing prospective customers to the site that understand the proposition.

This is true for a home gym equipment business who used TV to communicate the value of having an online community alongside with their equipment. Analysis showed that this brand reached 200k visits per week at a cost per visit 300 times lower than their hero product’s price through their TV campaign.

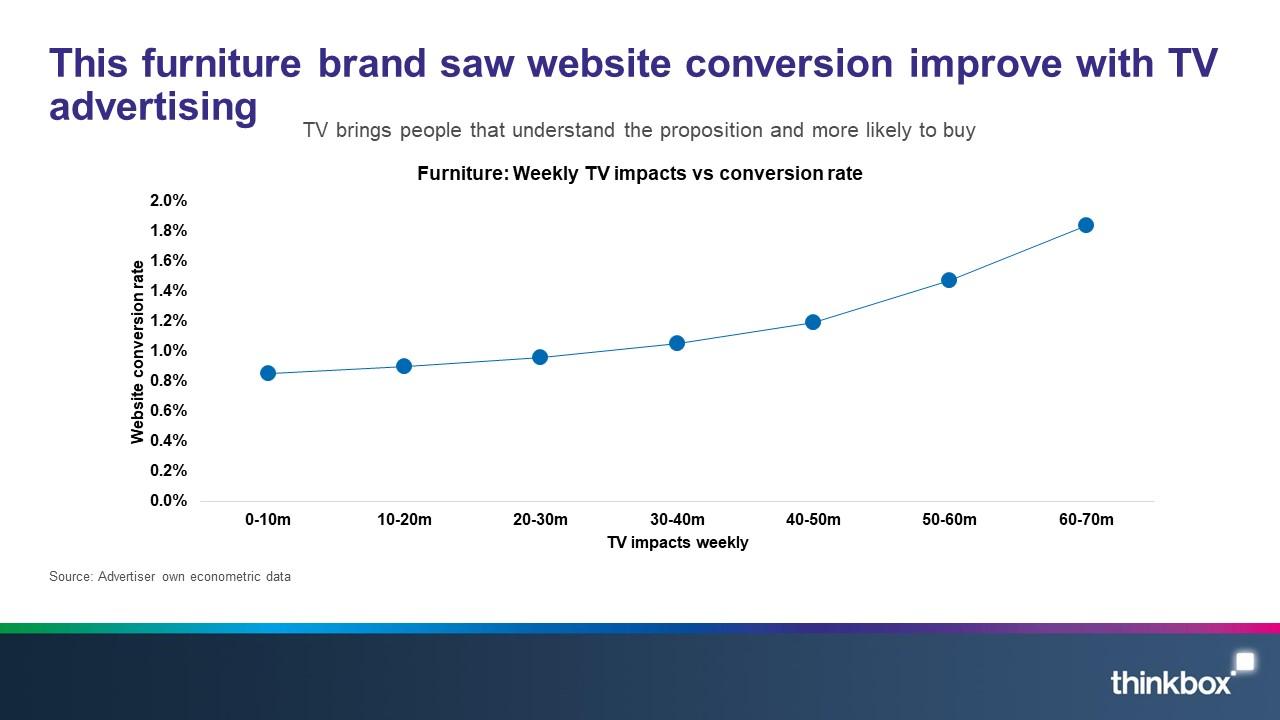

TV brings people with the right ‘level of intent’ to the site, who have already understood the proposition and are ready to buy. A method to measure the ‘level of intent’ is to analyse the website conversion rate (the proportion of all visitors that purchased). The below chart shows the conversion rate as well as TV impacts for a furniture brand. On average, in weeks when more TV ads were watched, the website conversion rate is higher. This highlights that TV brings consumers who are more likely to complete the purchase journey. This brand can be seen increasing their volume of traffic through a larger TV presence to drive awareness and consideration and ultimately increase their conversion rate.

When you need to scale fast

The boom of online businesses has seen incredible growth from brands who are battling to stay at the top of their category. These brands are often driving the digital disruption of a category and find that they need to scale quickly so they can dominate against their competitors – a strategy seen in meal kit brands, price comparison websites and more recently selling cars online.

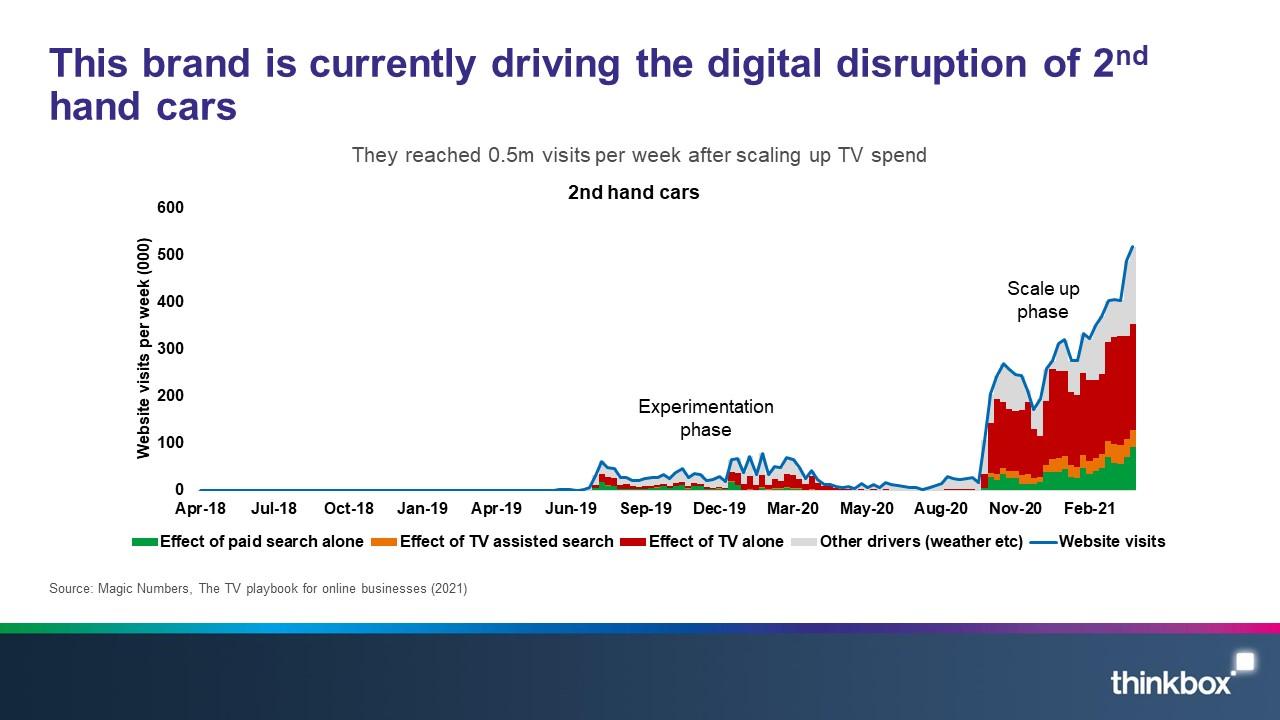

Of the brands analysed, a second-hand online car dealership (driving the digital disruption within their category) reached 0.5m visits per week after scaling up TV investment.

When you run out of efficient online buys

The third sign that you are ready for TV is when your normal marketing mix (typically performance marketing) no longer seems to be working – key signs include a loss of efficiency in offline channels or slow / no growth. Therefore, the usual media mix must be reviewed and replaced with an alternative strategy to continue to unlock growth.

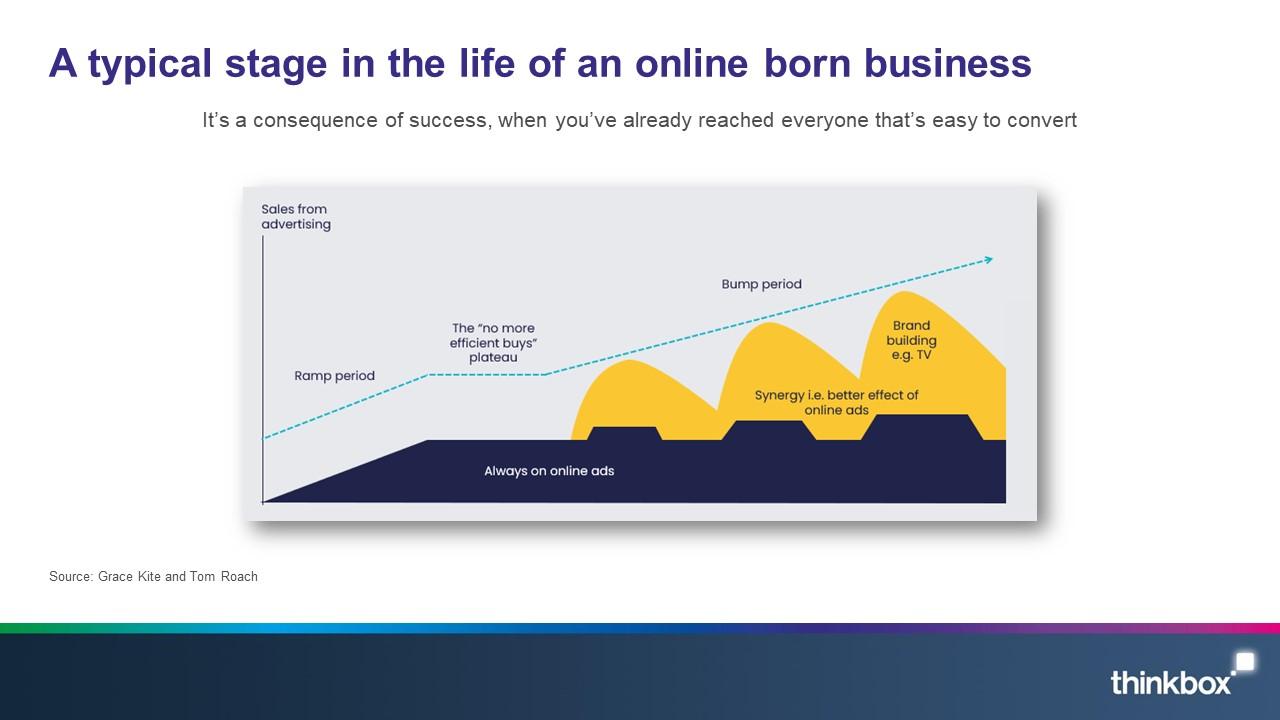

As seen below, the typical life cycle of an online born business begins with initial growth, ramping up through short lived activation ads online and sustaining performance activity to communicate to consumers that are in market, especially those who are not loyal elsewhere. After a period, this growth becomes stagnant, and brands need to reach outside the immediately available pool of customers to grow. Eventually, they are able to break through the plateau during the ‘bump period’, utilising brand building and attention holding media such as TV. Whilst the brands benefit from the direct effect of launching on TV, there is also a synergy between media as there is an increase in the effectiveness of their performance marketing channels (that they would have previously relied on.)

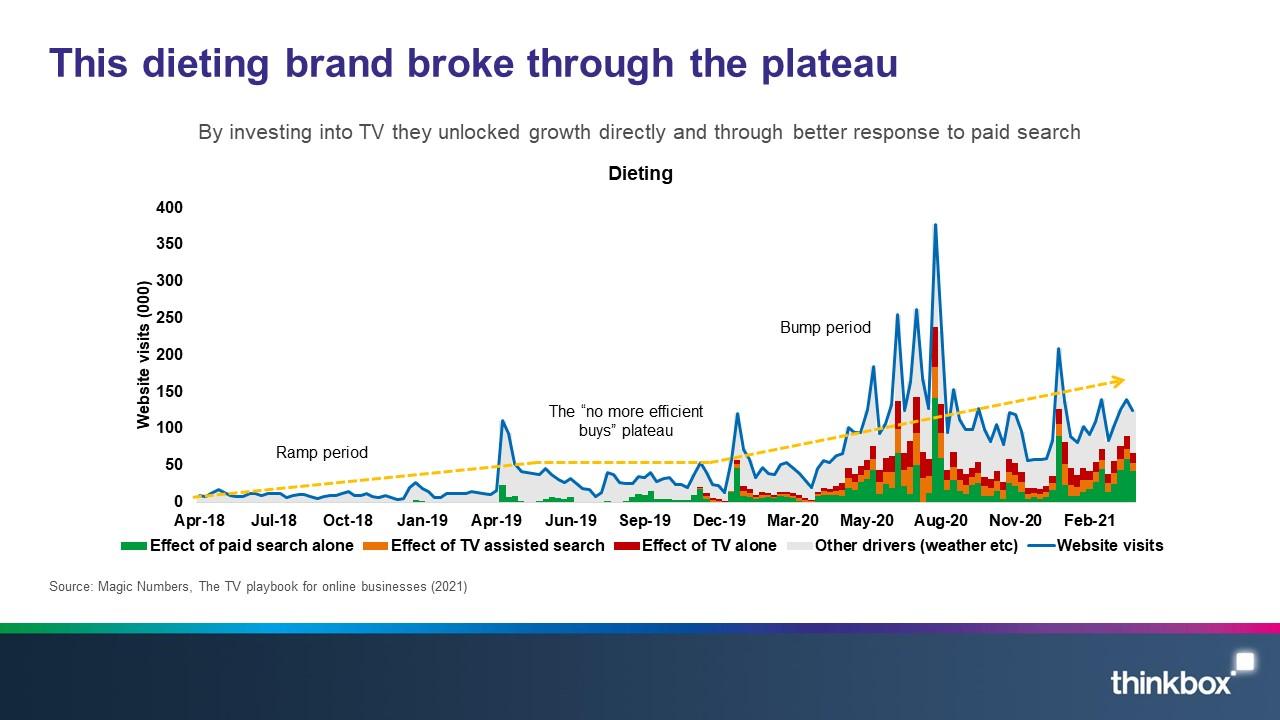

This pattern was seen in the brands analysed. TV modelling revealed that a dieting brand had a peak weekly web traffic of 111,000 visitors and an average of 23,300 prior to trialing TV. Following their TV launch, the peak rose to 378,000 visitors and the average increased to 99,000 visitors.

2.The effects of TV on your business

An immediate response visible in your dashboards

One of the benefits of TV is the immediate effect it can deliver, in this case a surge in website visits. Analysis across the brands modelled consistently showed a clear relationship between TV activity and web traffic. The uplift in website visits is visible regardless of the level of investment or the size of the launch and is likely impacted by the ease and convenience of searching immediately via a mobile device.

Naturally, these brands are dependent on marketing, with c.80% of visits driven by marketing comms. Across the 10 brands modelled, 120m visits were generated, with TV driving 42% of all visits (equivalent to 50 million in total.)

A big effect at a lower cost per visit than other offline channels (and comparable to that of search advertising)

The analysis found that TV is more cost efficient in comparison to Out of Home and Radio (the other offline channels used by the 10 brands). Despite the larger investment in TV (vs. Out of Home and Radio), the number of web visits driven showed that TV provided good value visits at scale.

Across the 10 brands analysed, TV drove 50 million visits at an average cost per visit of £2.11. A range of costs per visits were seen across the brands. A gift delivery brand delivered the cheapest cost per visit at £0.40 – this is a direct-to-consumer brand with a simple proposition who have optimised their TV plan over the years to target low cost visits. At the other end of the scale, a financial service brand delivered a cost per visit of £27.30, this brand sells mortgages which is a high-ticket product with a long purchase cycle, which can justify this higher CPV, but their TV strategy is more focussed on driving longer term credibility and trust in their brand, rather than visits. Despite this variance, the majority (6 of the 10 brands modelled) had a TV cost per visit between £1.90 and £2.50. In comparison to generic search where costs are hugely variable where a typical cost per click (visit) in gift delivery is £1-3 and in financial services £5-11.

Lasting ad effects that grow base sales

Brand TV and Out of Home advertising delivers lasting effects, with 50% of sales seen in the first 14 weeks following activity and the other 50% seen in the remaining two years after airing. This is in sharp contrast to Search and Social which have an immediate impact but short-lived effects.

TV is particularly potent for brands as this long-term strategy provides a safety net of base sales (i.e. sales that you generate without the need for marketing activity) in the event that marketing activity has to stop.

The only way we're going to get out of this trap of having to keep pushing money in, of 60% of our sales being driven by marketing, is by generating underlying brand awareness, underlying brand strength. The long-term strategic play, that base sales layer to fall back on

Cheryl Calverley CEO, Eve

3. TV drives cost-effective search

TV drives more cost-effective journeys because it prompts people to look for your brand not the category

Within search advertising, direct, organic and paid brand search visits are highly desired as these are the cheaper and, in some cases, free visits. TV and search have always been strongly linked. Brands can capitalise on these searches as analysis showed that most online journeys prompted by TV involve your brand name early which means lower spend in the search environment. TV (in comparison to Radio and Out of Home) lands the brand name better than the other offline channels as it encourages people to search the brand and not the category.

Of the journeys initiated by TV, 66% were direct/URL or organic search visits (which carry zero additional cost), 20% were paid for brand search clicks (which carry a small search cost), and 14% were for paid generic searches (that carry a high search cost).

4. A two-step approach to TV that works

This advice has been developed through the qualitative research with the industry experts who have successfully used TV advertising to grow online businesses, alongside the strategies employed by the 10 brands modelled in the econometric analysis.

Start with acquisition / response focused TV that allows test and learn

When delving into the world of TV advertising, acquisition or response focused TV provides an initial starting point for a brand to test and learn the best approach for their business.

This type of TV advertising is often referred to as DRTV (Direct Response TV).

DRTV can be mistakenly thought of as daytime and weekday only airtime, as it’s a legacy term from the days of call centres – you’d plan your response focused campaigns to play out at a time when someone was there to pick up the phone.

But with response now, in the main, occurring via the internet, there are no boundaries for when someone responds to an ad they’ve just seen.

It does though, still refer to lower cost airtime, which generally means, no prime time (8-11pm) on the larger channels. DRTV should be thought of as TV advertising that conforms to the following parameters:

- Targets an immediate response (call to action focussed creative, airtime targeting the audience most likely to buy)

- Lower priced airtime (no peak on larger rating channels)

- The next stage of growth will likely require a move away from an efficiency-based strategy

Depending on your brands circumstances, there is a right way to shift into brand focussed advertising which is working with agencies and using a different strategic approach:

- A move away from test and learn into professional media planning

- And a move away from the kind of creative content that works online to higher quality and more expensive films, made by an advertising agency

There are already a number of very good agencies that are specialised in working with online born brands:

- They’ve done this before and can offer the right advice

- And they can negotiate good deals on TV spots because they are always buying space from the big TV media owners and have the right relationships

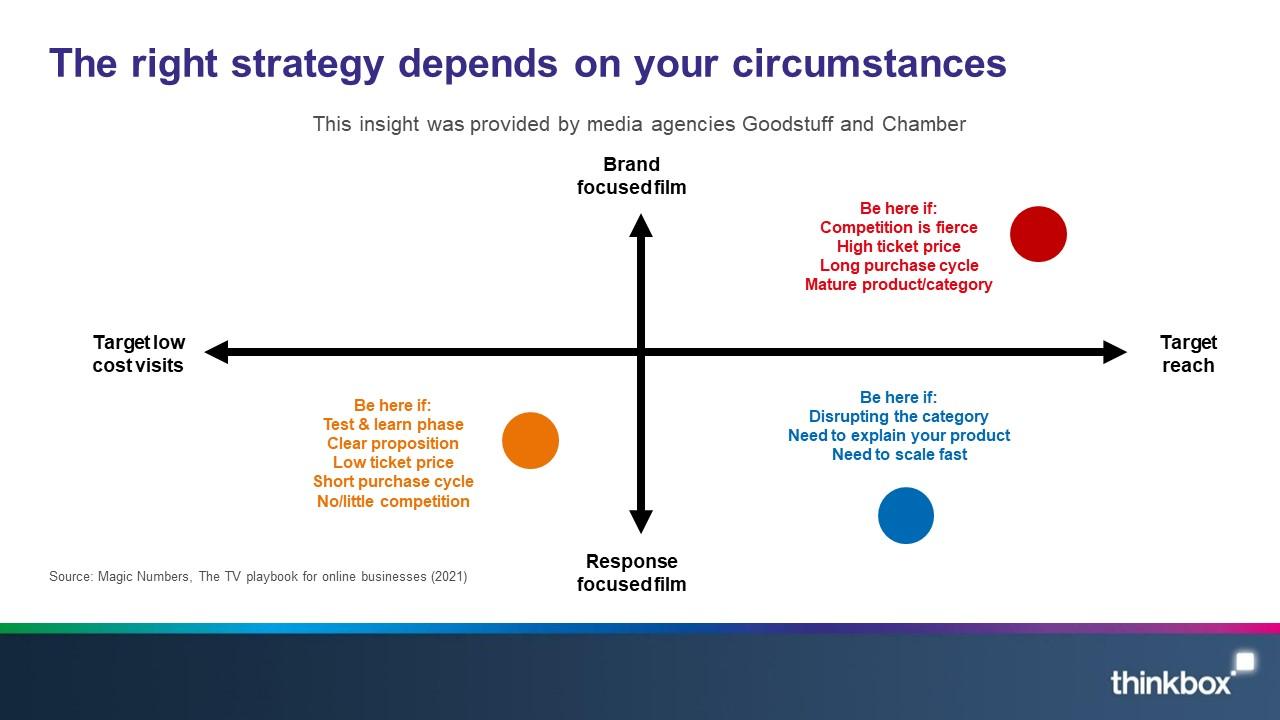

The graphic below helps provide a rough view of the right strategy for your particular situation.

As described in the first step - you’ll likely start in the bottom left on this chart, targeting low-cost visits with a response focussed film and you may well never need to move from that quadrant if your circumstances continue to suit this strategy: that is when the sell is not a particularly hard sell; you’ve got a product that’s easy to understand and not too expensive; and the competition isn’t too fierce.

But when you hit the ceiling, i.e. increasing spend through this strategy no longer drives incremental web traffic, you’ll likely need to move out of that quadrant and start to either pay a bit more per visit, but reach more people and get a larger scale response - or invest in a richer creative that is capable of generating a longer lasting impact – or both - and if you go for both you’re going to be moving towards the red corner on this chart, which is where brand building advertising is necessary.

The blue corner is one that’s not typically talked about for established TV advertisers. But this is an important option for many online brands and particularly those that are disrupting their category, doing something very different, or need to scale fast. This is where you try to reach as many potential category buyers as possible, but the ad itself doesn’t have to be focussed on delivering an emotional connection – the new way of doing things is better, right? The job for the ad is to introduce that new way and explain it.

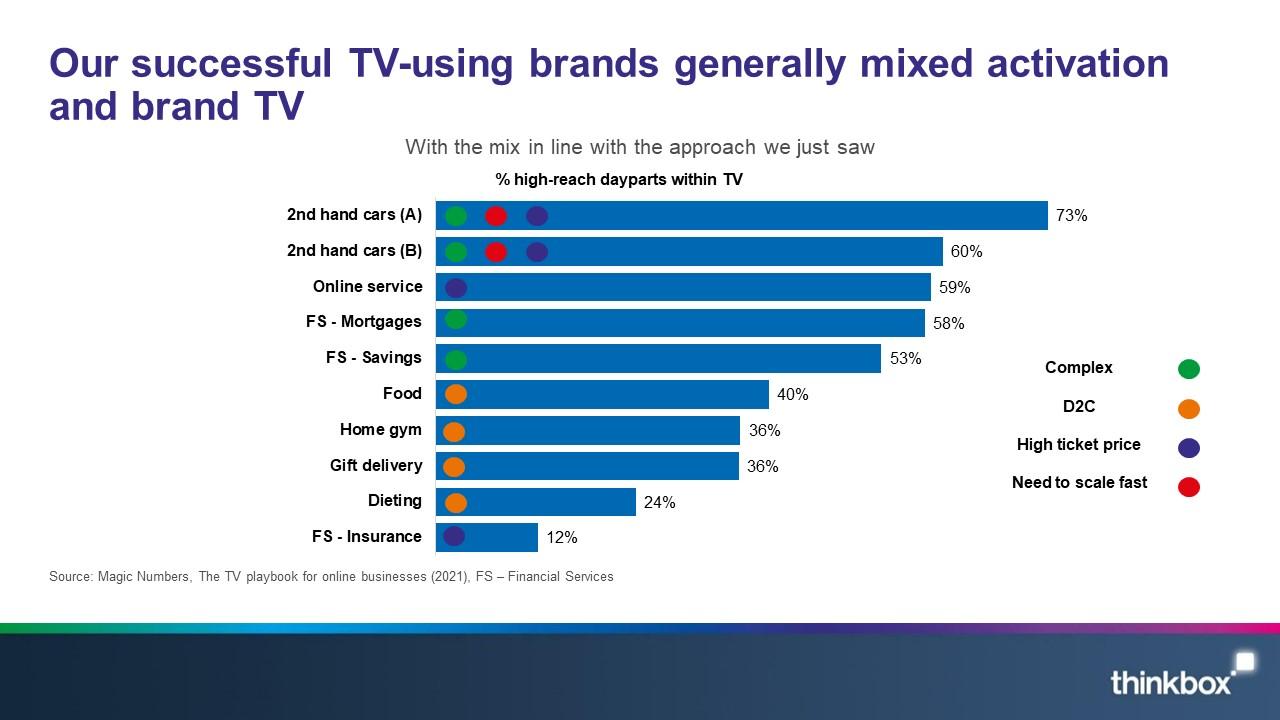

Don’t take this chart too literally, the most likely solution will be a blend of brand and activation, but many advertisers in this study, who have all successfully seen growth through TV advertising followed this suggested approach:

- The brands that have a complex product, need to scale first and fast, or had a high-ticket price – tended to go for a mix that had a lot of high-reach dayparts.

- Those that had a relatively simple proposition, a clear thing they are selling that can just be sent straight away tended to stick more with the cheaper, lower rating dayparts.

In summary

Three signs it’s time for telly:

- You have a clever new product – you need to educate and drive visits at the same time.

- Need to scale fast - you and competitors are driving digital disruption of the category.

- You’ve run out of efficient performance marketing buys and need to look elsewhere.

The effects of TV on your business:

- An immediate response visible in your dashboards.

- A big effect at a low cost per visit - expect £1.90 – £2.50.

- A layer of base sales to rely on if you ever need to switch off advertising.

TV drives cost-effective search:

- TV drives cost effective web visits because it prompts people to look for your brand not the category.

A 2-step approach to TV that works:

- Start with TV that allows test and learn, and is keenly priced, i.e. lower rating channels and dayparts.

- Depending on your brands circumstances, there is a right way to shift into brand and reach focussed advertising, which will likely involve working with agencies and using a different strategic approach.

Thinkbox

Thinkbox