In Brief

Signalling is a powerful force. It’s the motivation to buy flash, rather than functional cars; it’s the reason a peacock has an exuberant but impractical tail, and it’s the driver behind designers adorning Hollywood heavyweights with their latest red-carpet creations.

We also believe that signalling ties in with public promises and that promises made in public carry more weight than those made in private. If they didn’t, we’d all get married Vegas-style.

But what does this have to do with media?

The principle of media signalling suggests that the perceived cost and scale of an advertising channel can enhance brand attributes in the eyes of the consumer.

We’ve long believed that the media channels you select can impact the brand message your audience receives. However, there’s relatively little out there to help us understand and quantify those effects. We wanted to understand how these signals differ between advertising channels and how planners can use them to optimum effect for their brands.

Key findings

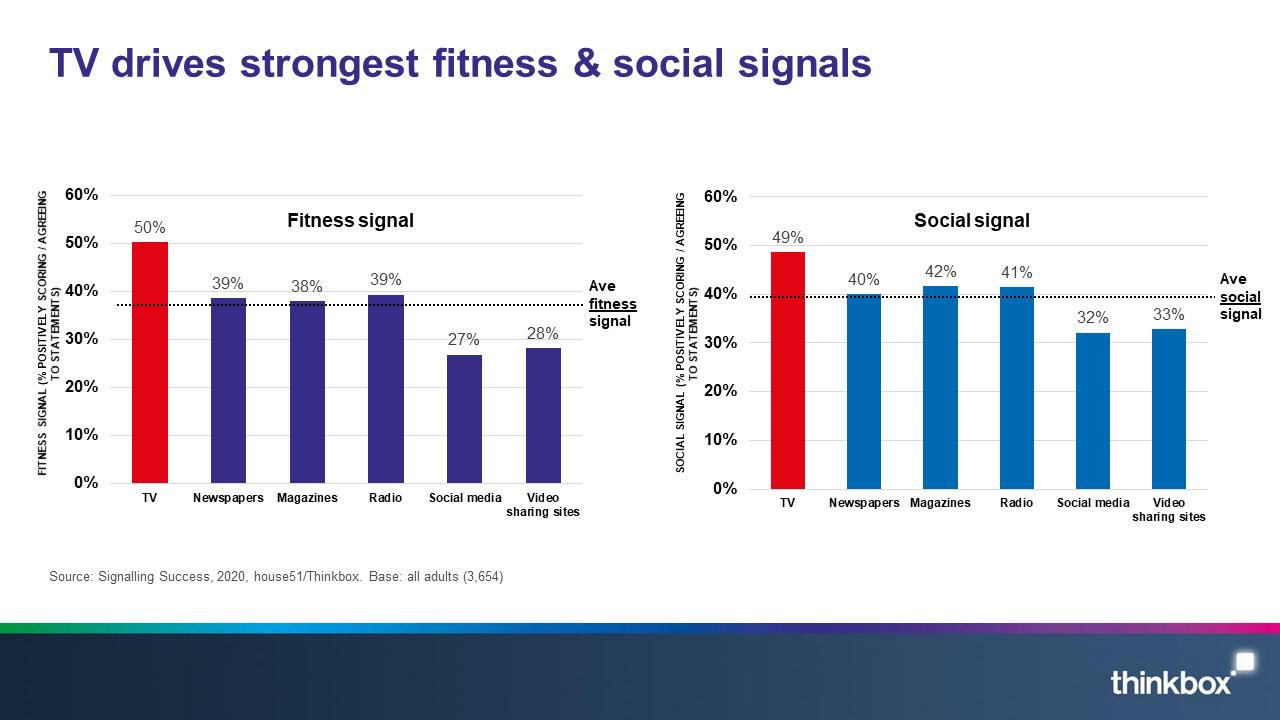

1. Advertising drives ‘fitness’ and ‘social’ signals.

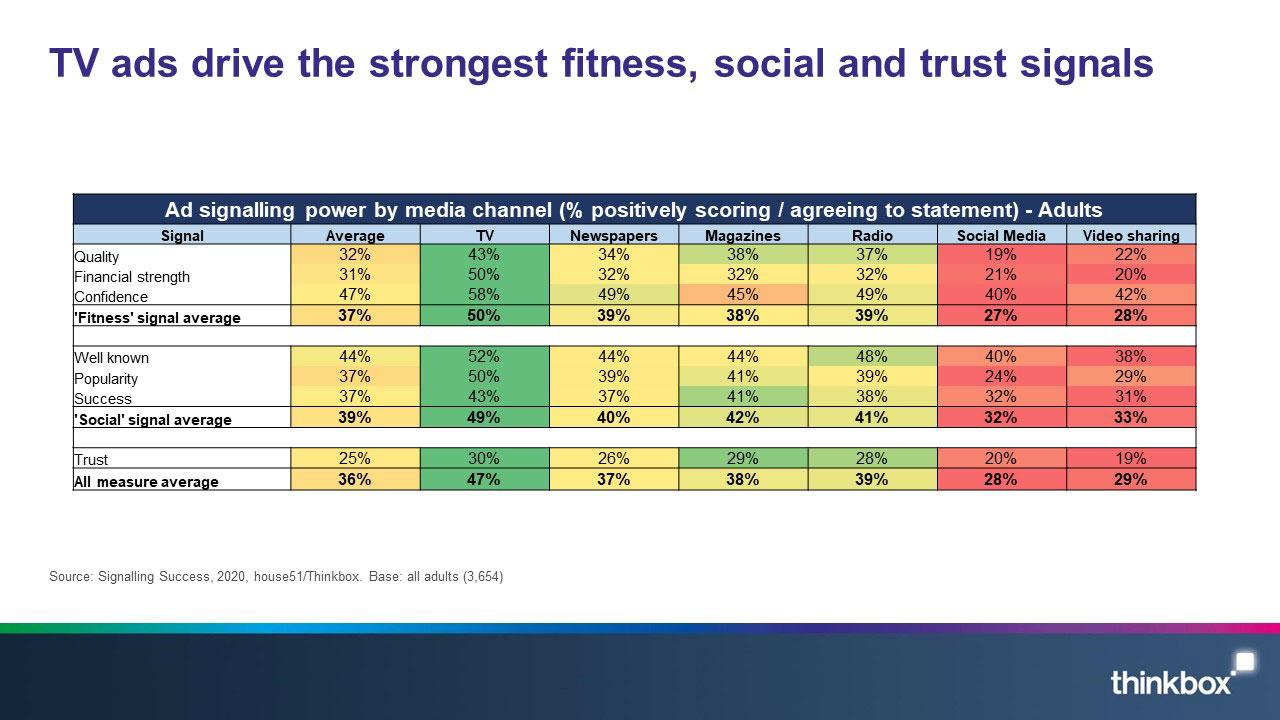

- Fitness signals are about financial strength, product confidence and quality. Social signals are about fame, popularity and success. Both are valuable signals but the ability of media to convey those signals varies greatly.

2. TV drove the strongest fitness and social signals in all product categories tested and outperformed social media and online video across every category.

- The relative performance across each media varied little by category with TV driving the strongest signals for online retail, FMCG, mobile networks and home insurance.

- Social media and video sharing sites were the advertising channels least likely to drive these signals across the categories tested.

- TV delivered stronger fitness and social signals for all age groups, including younger audiences.

3. Brands which advertised on TV were significantly more likely to be perceived as financially strong, high quality and confident

- TV advertising’s ability to drive the above fitness signals outperformed all other media tested. (36% stronger than the average.)

- Half of all respondents rated brands that advertised on TV as financially strong.

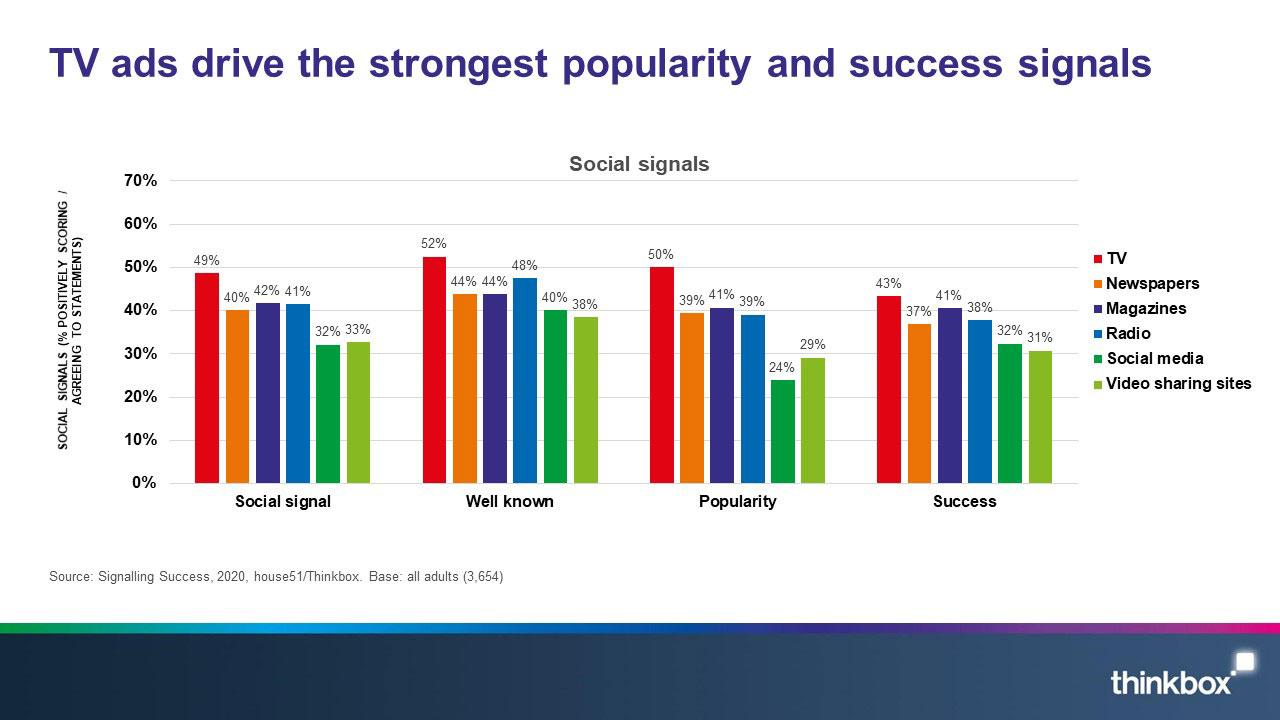

4. TV advertising helped brands convey popularity and success more than any other medium.

- TV was 23% stronger than average in delivering social signals.

- Half of all respondents rated TV advertising as demonstrating that lots of people were buying the brand.

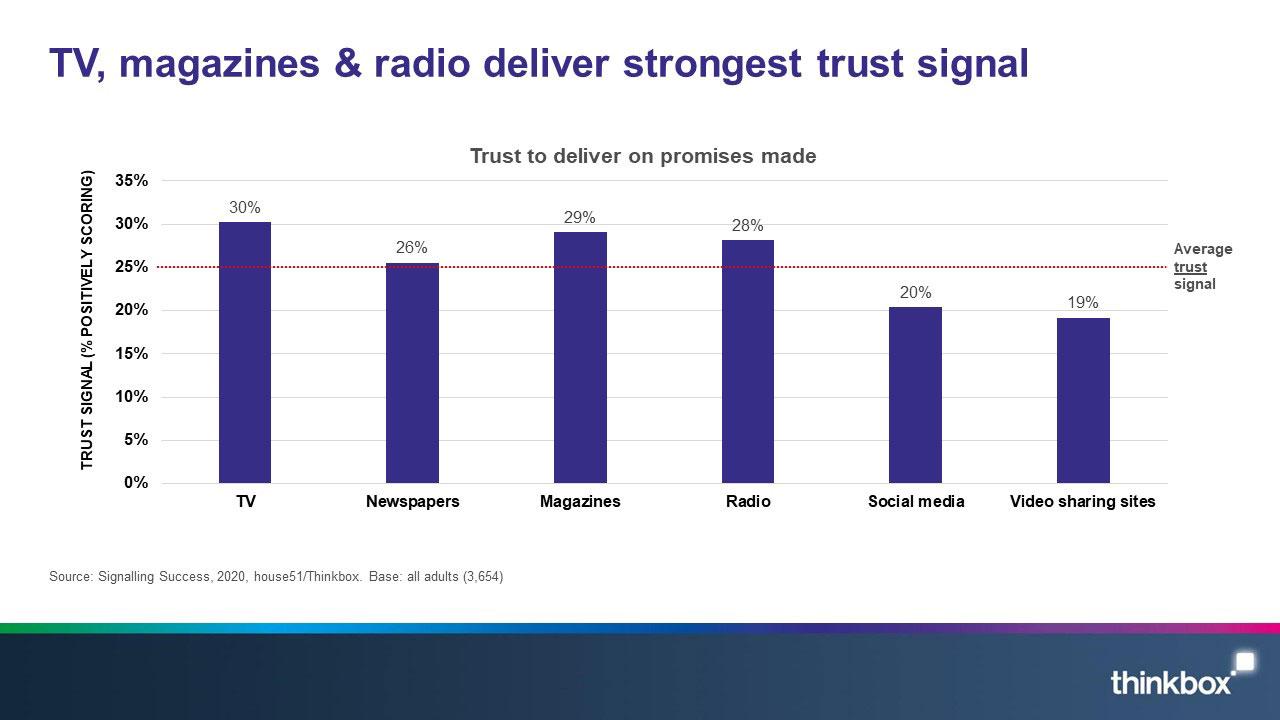

5. Brands advertising on TV, magazines and radio are perceived as most trusted to deliver on promises made

- A third (30%) trusted TV advertising to deliver on the promises made, making TV the most trustworthy medium, just ahead of magazines (29%) and radio (28%).

- Advertising on video sharing sites was least likely to deliver brand trust at 19%.

In depth

Background

We’ve long believed that the media channels you select can have a halo effect on the brand message your audience receive. Part of the benefit of advertising is that it’s a public declaration of trust, reliability and authenticity. This is especially true of TV.

Although this is a subject that has been studied, the research has been conducted within the academic sphere, which is rarely representative of the whole population. In addition, most of the literature is over 20 years old and doesn’t account for the huge impact that the internet has had on our media consumption.

Since the pandemic changed our lives and flung much of the globe into recession, we know that signals such as advertiser trust, financial stability and product confidence are arguably more important than ever.

We needed to understand how this works in practise and how advertisers can utilise different media channels to optimise their brand signalling.

Methodology

Before we conducted the research, behavioural scientist Richard Shotton undertook an extensive literature review, identifying what we know already and where the prominent gaps in understanding lie.

Off the back of those, research agency house51 created the research framework and conducted the study, which centred around a nationally representative quantitative survey of 3,600 people in the UK. The study covered TV, newspapers, magazines, radio, social media and video sharing sites. As the study took place in lockdown, cinema and out of home were not included in the methodology as the social situation could have inadvertently biased the results for these channels.

The research was an experimental design, inspired by US academic research from Duke and Stanford universities. Each respondent was presented with a description of a fictionalised brand in either online retail, FMCG, mobile phone networks or the home insurance categories, and given a brief outline of its launch advertising campaign. In each case, all information was identical except the medium being used in the campaign.

This allowed house51 to isolate the ‘signalling effect’ of the media channel, as all other variables were identical for each respondent. A mix of explicit questioning and implicit timed responses were used to assess the strength of the signals. However, trust was also measured implicitly as it’s challenging to measure this metric accurately through explicit questioning alone.

In addition, we conducted a short qualitative phase where we interviewed ten respondents at length about their media and brand perceptions, which added depth to the findings and allowed us to dig more deeply into certain topics.

The study is the first-known UK research dedicated to the behavioural science principles of ‘costly signalling’ and ‘public promises’ and their effect on advertising. (Both are subjects which have been much discussed by academics and behavioural scientists in recent years, including Rory Sutherland.)

The principle of ‘costly signalling’ suggests that the perceived cost and scale of an advertising channel translates to improved brand attributes in the eyes of the consumer.

Findings

1. Advertising drives ‘fitness’ and ‘social’ signals.

As part of the initial literature review of this study (conducted by Richard Shotton), it became clear that advertising created two main kinds of signal that were key to sales generation.

The first of those are ‘fitness’ signals and these were the primary focus within the literature. These are signs of financial robustness, product confidence and overall quality. For example, for an advertiser to spend large amounts of money on advertising, it is likely that their business is financially viable and that there is a level of confidence in their product or service. Many people understand that most advertising channels within the UK are regulated, so there is also a perception that the advertiser’s claims must stand up to scrutiny.

Where the literature fell short were on the ‘social’ signals. These include elements such as brand fame, popularity and success – all of which we believe are highly important but have received relatively little attention in recent years. (For example, part of the power of brand fame lives in the fact that the audience knows that everyone else knows the brand is famous too.)

2. TV drove the strongest fitness and social signals in all categories tested and outperformed social media across every category.

Performance across each media varied little by category but TV drove the strongest signals in all categories tested (online retail, FMCG, mobile networks and home insurance).

Social media and video sharing sites were the advertising channels least likely to drive these signals across the categories tested.

TV still delivered stronger fitness and social signals across all categories, regardless of age.

3. Brands which advertised on TV were significantly more likely to be perceived as financially strong, high quality and confident

TV drove the strongest fitness signals, 36% stronger than the average. Radio was second best performing media coming it at 7% above average.

Interestingly, half of all respondents rated brands that advertised on TV as financially strong – undoubtedly driven by the perception that TV is one of the most expensive advertising media (actually, it's very cost-effective). The next best performing channels for signalling financial strength were newspapers, magazines and radio, all at 32%.

Brands that advertised on video sharing sites and social media, consistently scored below average in driving fitness signals. Just 19% of respondents rated brands that advertised on social media as being high quality. This compared with video sharing sites at 22% and the top performing medium, TV, at 43%. This is likely to be heavily influenced by the lower point of entry in terms of the perceived cost of advertising on these channels. In addition, the company brands keep is likely to have a marked effect. If a medium is saturated with small, lesser-known advertisers that will impact on the strength of the fitness signals.

One fascinating finding to emerge from the research was centred around channel brands. When participants in the study were told the campaign was running on a branded channel that they regularly used, as opposed to generically running across a whole media channel (i.e ‘The Times’ rather than ‘newspapers’), there was a large increase in the perception of both fitness and social signals generated for both news brands and, to a lesser degree, magazines.

The signalling power of TV didn’t differ when a branded channel was named. Whereas the signalling power of social media dropped when the respondents were told that a campaign was running across a social media platform that they regularly used.

This reflects consumption across these media. Whilst people are generally driven to consume by the content on media channels (for example, a TV programme is more important than the channel it’s shown on), for news brands and magazines, the reverse is true: people seek out their preferred news or magazine brand first and tend to have strong allegiances with it. However, we are unsure why campaigns running in a preferred social media platform had a negative impact on the results.

4. TV advertising helped brands convey popularity and success more than any other medium.

TV was by far the best driver of social signals and outperformed the average by 23%. Magazines followed at 6% above average, highlighting the importance of broadcast media in demonstrating brand fame.

Almost half of all respondents (43%) rated brands advertising on TV as successful, which was slightly ahead of magazines at 41%. Social media and video sharing sites were the least likely to signal brand success at 32% and 31% respectively.

50% of respondents rated TV advertising as demonstrating lots of people were buying the brand. TV, magazine and press advertising also all helped signal brand popularity, but to a lesser degree than TV.

This may be connected to perceptions of reach. Although the differentiation was less than for the signals relating to fitness, TV was still perceived as having the broadest reach of any media and we know from studies by the likes of Binet and Field, that reach and fame are inherently linked.

5. Brands advertising on TV, magazines and radio are perceived as most trusted to deliver on the promises made in their ads

In line with other research, brands advertised on TV were viewed as the most likely to deliver on their claims, with a third (30%) trusting what they say. Magazines and radio followed closely behind at 29% and 28% respectively.

Trust in video sharing sites, however, was significantly lower, accounting for just 19%.

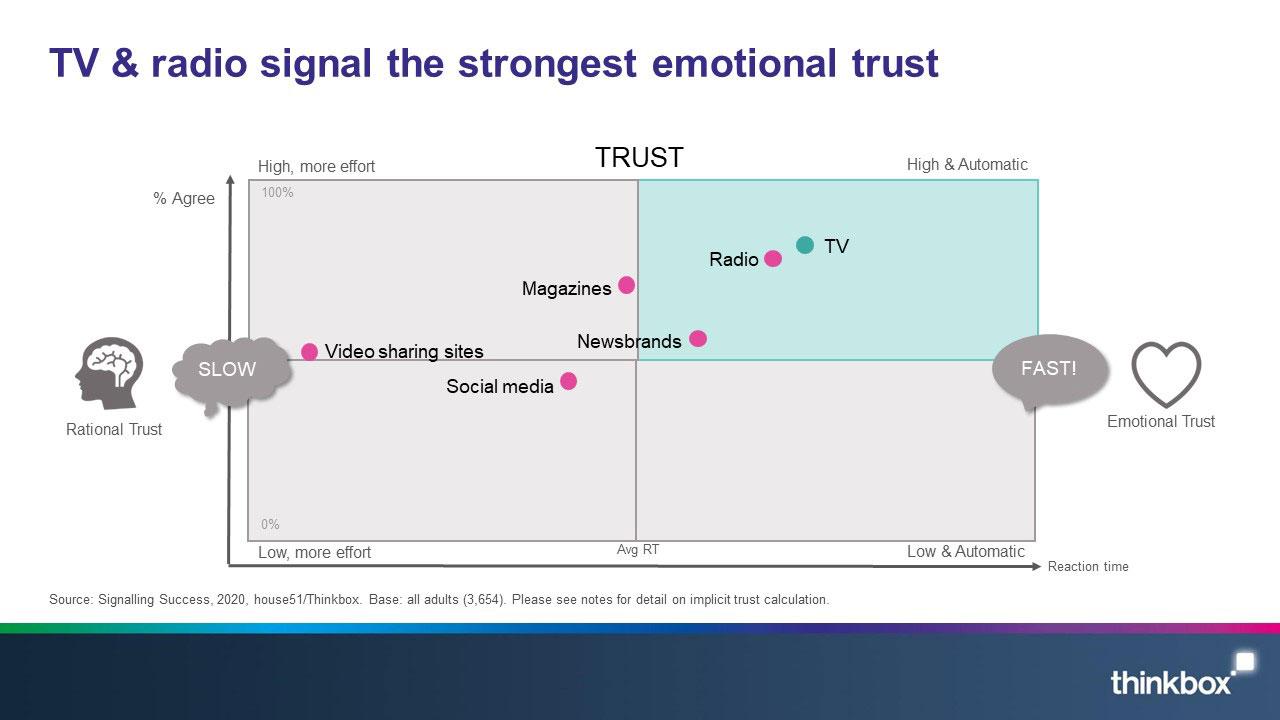

In addition, the implicit test demonstrated that the trust in TV and radio was significantly stronger and more automatic than the trust in social media and video sharing sites. This implicit test timed the speed with which respondents agreed or disagreed with a statement. house51 termed this automatic response for instinctively trusting a media channel to deliver on their promise as ‘emotional trust’.

This is important for brands as emotional trust is deeper, and therefore more resilient, than trust based on rational thoughts. Whilst rational trust can disappear after just one bad brand experience, emotional trust generally weathers the storm. It’s based on an understanding that even though the experience fell short of expectation, brands with high levels of emotional trust will effectively be given a ‘second-chance’ - the negative experience is seen as more of a blip than a dip.

Implications for advertisers and planners

In his recent book ‘Alchemy: The Surprising Power of Ideas that don’t Make Sense’ Rory Sutherland encourages advertisers and planners to get comfortable with how humans make decisions in the real world. And that’s via a combination of ‘psycho-logic’ and social intelligence.

Logic is what makes a successful engineer or mathematician, but psycho-logic is what made us a successful breed of monkey that has survived and flourished over time. This alternative logic emerges from a parallel operating system within the human mind, which operates unconsciously and is far more powerful and pervasive than you realise. Rather like gravity, it is a force that nobody noticed until someone put a name to it

Rory Sutherland2019

While many of these basic principles of psychology and behavioural science appear to have become mainstream in advertising and planning, Sutherland argues that the ‘narrow logic’ of economists (i.e. efficiency) and technology evangelists (i.e. hypertargeting and personalisation) continues to dominate.

For Rory, the trick to being an alchemist is in knowing when to abandon the narrow logic.

Our research shows that brands of all shapes and sizes can harness the power of ‘psycho-logic’ and ‘social intelligence’ via their media choices and, particularly, the use of TV advertising as the strongest source of costly signalling and brand fitness.

Here are a few practical thoughts for advertisers and planners

For media planners:

The emotional power of video is well established. But our research reinforces the point that ‘not all video is the same…’ and video platforms are not interchangeable. We already know that TV, social media and video sharing sites don’t deliver the same in ‘hygiene factors’ such as view through rates and whether the sound is on. But our research shows that the ‘psycho-logical’ and social/cultural signalling power of TV is far superior:

- TV advertising is perceived to be costly and takes more effort to makeTV advertising is significantly stronger than video sharing sites and social media in signalling brand fitness, quality and trust.

- People intuitively understand that TV advertising is seen by many peopleWhen it comes to TV advertising, we know that many other people are seeing the same thing we are, at the same time. Other video platforms have appropriated the language of ‘social’ and ‘community’. However, the reality of hypertargeting and personalisation on social and video sharing platforms is that people have no idea what advertising other people like them are seeing, or what information they are receiving about a brand. This means that social media and video sharing platforms are much less effective than TV at building ‘common knowledge and cultural meaning’. That is why TV remains the best way to build popular, mass market consumer brands.

For smaller, lesser known brands:

Building and maintaining trust is crucial for any brand. Big brands build their reputation and deep emotional trust through years of positive product experiences and nurturing relationships with their consumers. This makes them incredibly resilient when things go wrong (think Volkswagen and the emissions scandal). It’s hard for new or small brands to compete with this.

This research shows that TV advertising is a great way to accelerate trust. For an unknown brand, TV generates stronger levels of explicit and emotional trust than any other medium, providing much needed resilience for new and small brands in an increasingly volatile and unpredictable market.

For bigger, well known brands:

Costly signalling theory shows that humans, just like other animals, are highly attuned to quality and reliability signals and they decode these signals emotionally, as well as rationally.

In a marketing context, this means there can be a high degree of variation in how competing brands signal quality and reliability based on complex interaction of factors like product attributes, messaging, creative execution and media choice.

This data shows that TV advertising remains a strong source of differentiation on attributes like quality and reliability that ladder up to overall perceptions of brand fitness and trust.

Costly signalling matters now, more than ever

It goes without saying that we are currently living in unpredictable times. Risk and economic uncertainty are highly salient for everyone. In the advertising industry, the instinctive reaction of many to signs of recession is to double down on cost-cutting and efficiency.

But evolutionary biology and psychology (and a wealth of advertising industry case studies and data) shows that applying the ‘narrow logic’ of efficiency is the wrong way for advertisers to respond to recession.

Animals and humans rely on the ‘psycho-logic’ and social intelligence provided by costly signals to mitigate risk and inform their decisions. When it matters most, we are instinctively drawn to the highest quality and fittest option.

In this context, social media and video sharing platforms may appear efficient, but these platforms are far less effective than TV at conveying the vital, unconscious information that helps consumers mitigate risk and maximise confidence in their brand choices.

Supporting data:

Thinkbox

Thinkbox