The world has been turned upside down in recent years. Pandemic, war, energy crises, labor markets in chaos, rising intertest rates, and the biggest rise in inflation for decades. It’s a cocktail of economic instability and uncertainty. Here adam&eveDDB’s Head of Effectiveness offers some guidance for advertising in tough times, starting with the need to recognise advertising as an investment…

Key points:

- Revenues will grow this year for most brands, especially FMCG brands and those in less discretionary categories. Think about what will happen to your revenues and tailor your strategy accordingly.

- Protect profit margins when costs are rising by shifting budgets from discounting and price promotions into the brand advertising that will reduce price sensitivity and support firmer pricing.

- For those brands that can afford it, this is a time to exploit cheap media. In real terms, advertising for fixed inventory media like TV will be amazing value. It’s a cheap time to buy share of voice and market share.

- Strong brands that keep advertising through a recession find it easier and cheaper to borrow money. That makes capital investment more viable.

- Don’t rely on simple attribution modeling, which gives wrong answers. Supplement digital metrics with controlled experiments and econometric modeling to measure true ROI.

- Optimize your effectiveness through good media planning, combining both new channels with established media like TV to get the broadest possible reach.

- Harness the magic of creativity. Create emotion to allow creativity to have its full effect in order to drive sales and profits. TV can unlock that magic.

Across the globe, marketers are asking "Is it time to cut advertising costs?" This is understandable, given the pressures they are under.

There's no simple answer. In order to know whether you should cut, how much you should cut, and what you should cut, you need to think about advertising not just as a cost, but as an investment.

Think about how advertising benefits companies. Advertising is a cost in the short term, but it's a powerful way of generating extra sales and profit in the short, medium and long term. Just like any other financial investment, it’s about putting money in now to create a flow of incremental profits in the future to maximise shareholder value.

It will be a tough year for many, but the following five consideration can help guide you through the troubled times that may lie ahead.

What are your growth prospects?

When growth is rapid and strong, the case for advertising investment is easy. But if your brand is static or declining, it becomes much harder to justify investment in advertising or other marketing.

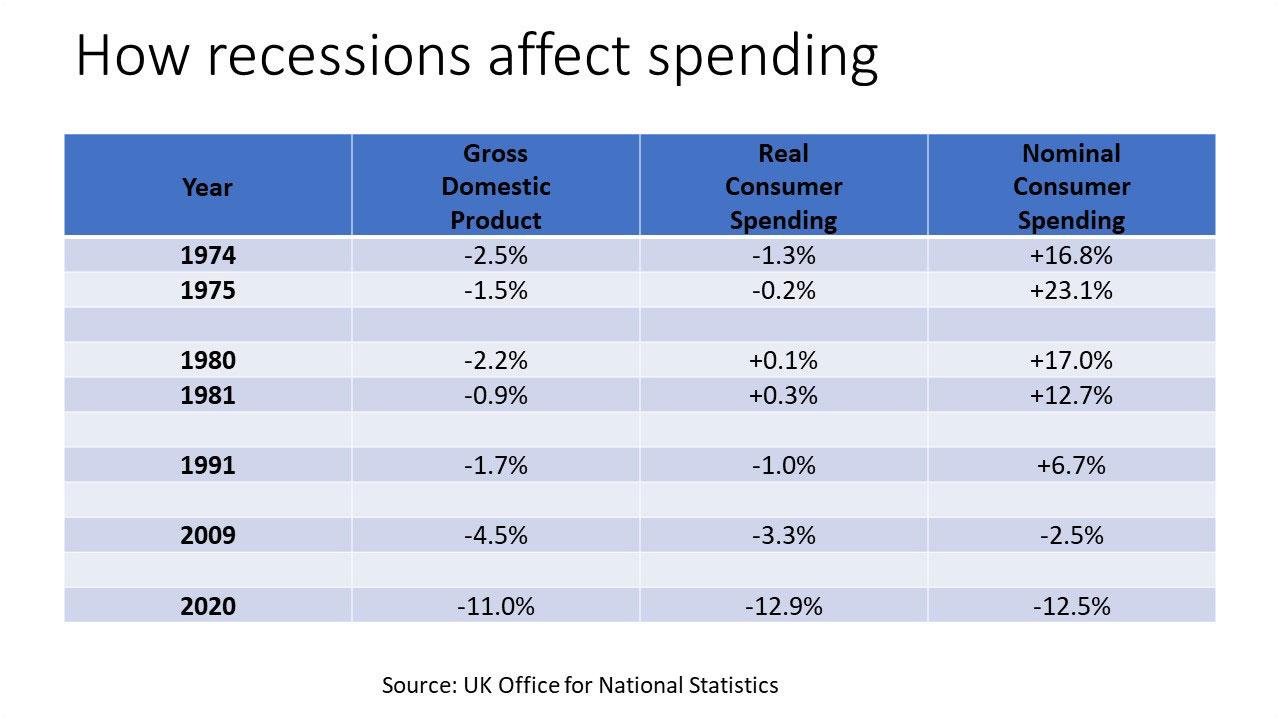

The last two recessions in the UK, in 2009 and 2020, saw sharp contractions in GDP of 11% and 4.5% respectively. But those were exceptional. The kind of contraction in GDP that we see for a ‘normal’ recession – like those in the 1970-1990s – is usually much milder, around 1-2%.

This is what we will likely see in the UK in 2023. In fact, the Bank of England is forecasting that GDP will probably grow slightly this year overall.

The 2009 and 2020 recessions also occurred during periods of very low inflation. We currently have the highest inflation rate for about 40 years. So, when thinking about what's going to happen in 2023, it's more realistic to look at what happened during high inflation recessions, like those in the 1970s, '80s, and '90s.

So the good news is that, during all of those higher inflation recessions, consumer spending actually grew in top-line nominal terms (because things cost a bit more). So most firms can expect to see consumer spending and top-line revenue growing this year.

Some sectors – and demographics – will do better than others

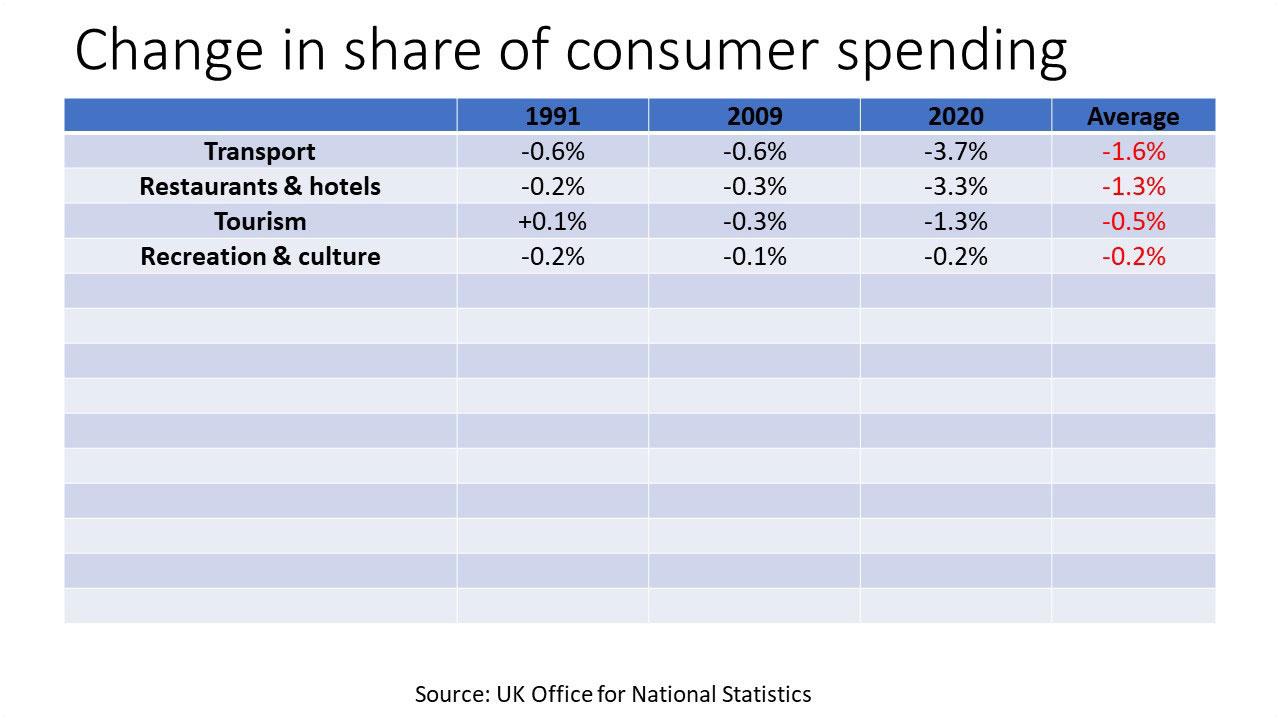

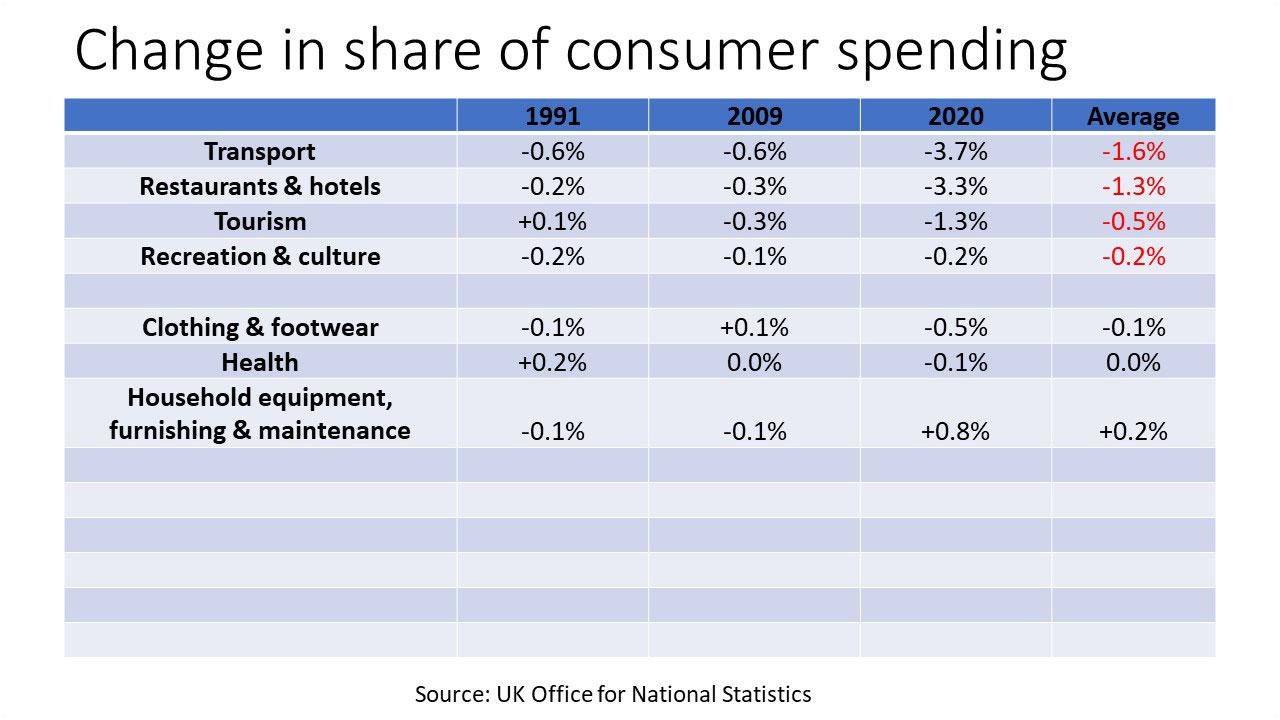

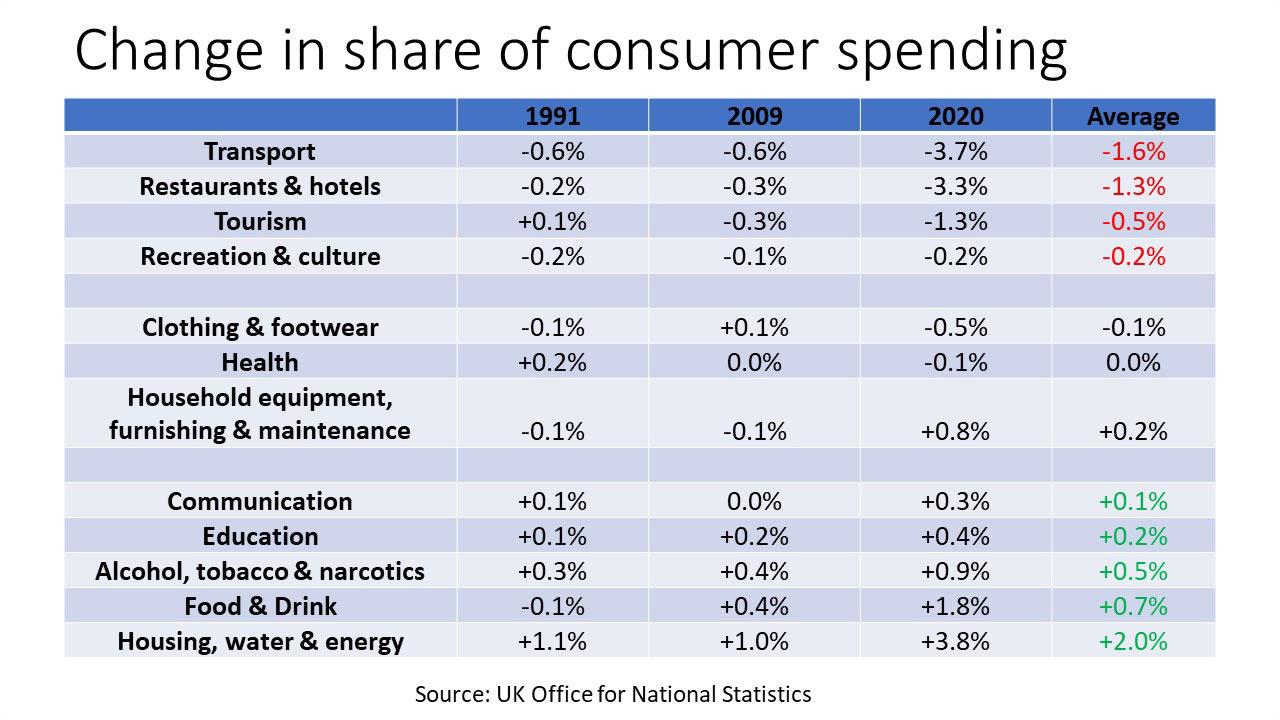

Transport, restaurants and hotels, tourism, recreation, culture…sectors that rely on our discretionary spending, our treating ourselves, those sectors tend to do badly when times are tough.

But there are lots of sectors that largely carry on as normal. Clothing, health, household equipment, durables...in recessions, these all sometimes performs a little worse than normal, sometimes a little better.

And some sectors – like FMCG – tend to do relatively well in a recession. These are the necessities, the very basic goods, and the smaller treats, so communication, education, food and drink, alcohol, and basic bills like utilities and mortgages.

As well as different sectors performing differently in recessions, some people do better than others too. With rising energy bills, mortgage rates, and rents, younger and poorer families are going to be suffering more than most because those are bigger components of their household bills. Conversely, older and more affluent households will be much less affected.

So, this might be a point at which a brand considers switching its audience focus. And this has implications for media, since younger consumers tend to watch more online video – from YouTube to broadcaster VOD – and older audiences are the biggest viewers of linear TV.

Maintaining profit margins

Costs are rising. We're seeing inflation in commodities, prices, input prices, wages and capital costs, and that's squeezing margins. In order to make your marketing payback, in order to make investment possible, you've got to maintain and restore those profit margins. That means passing costs on to consumers.

Price promotions are not the answer

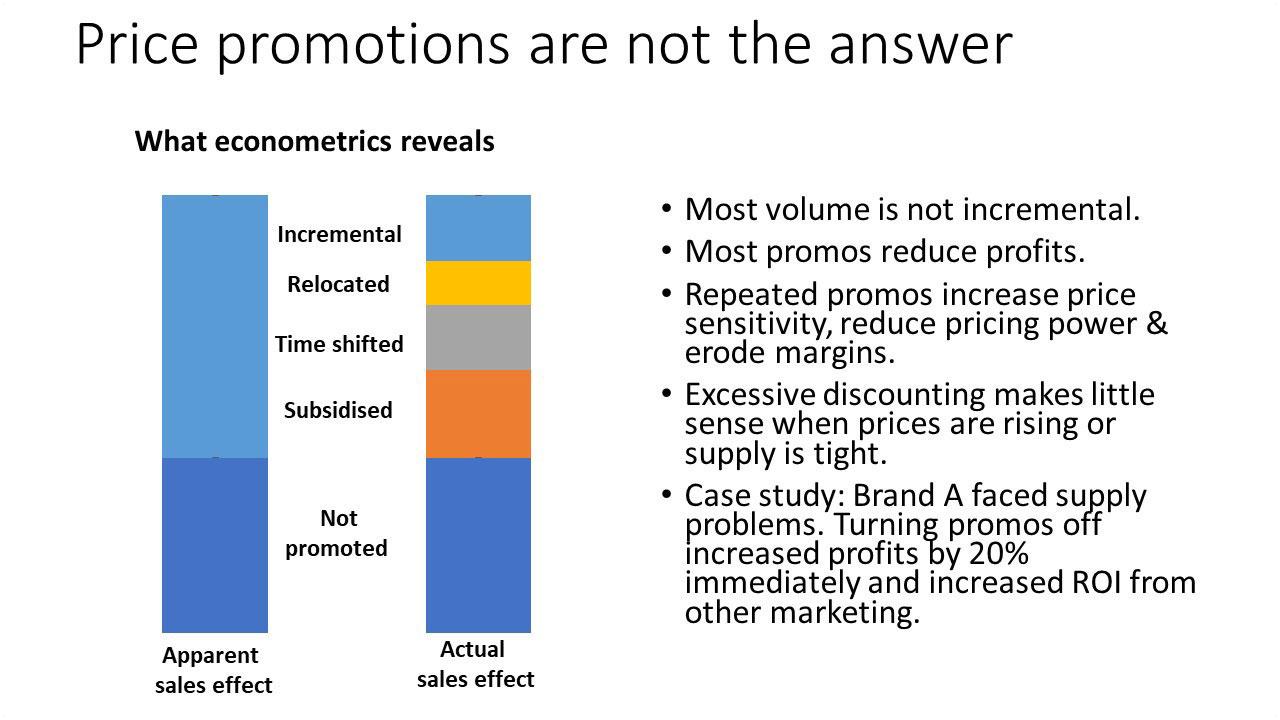

When times are tough, many marketers reach for an obvious answer: price promotions. But, although top-line sales data can suggest that price promotions generate lots of incremental sales, econometrics shows that these are not actually incremental.

Price promotions subsidise sales; they sell to people who were going to buy your product already, but gives them a lower price. They give away money.

As well as subsidising, price promotions also time-shift sales. They bring sales forward. You’re getting someone to buy two packs this week, rather than one pack this week, one pack next week. So you're not increasing the overall amount of sales, just getting them sooner.

And some sales are just relocated by price promotions. A promotion in Sainsbury's steals sales from Tesco. That's great news for Sainsbury's, but not necessarily good news for the brand owner.

The true incremental effect of price promotions is often much, much smaller than the top-line sales data reveals. Most volume is not incremental. Because most volume is not incremental, most promotions actually reduce profits for most brand owners. An analysis, a few years ago, by Nielsen, suggested that 84% of price promotions are actually unprofitable if you analyze them properly. Worse still, repeated price promotions increased price sensitivity. You're teaching people to buy on deal.

That reduces your pricing power, and therefore, erodes your margins – the opposite of what marketing should be doing, especially now. Price promotions don't make much sense for many brands in normal conditions, but when costs are rising, they are madness.

Use brand advertising to support firmer pricing

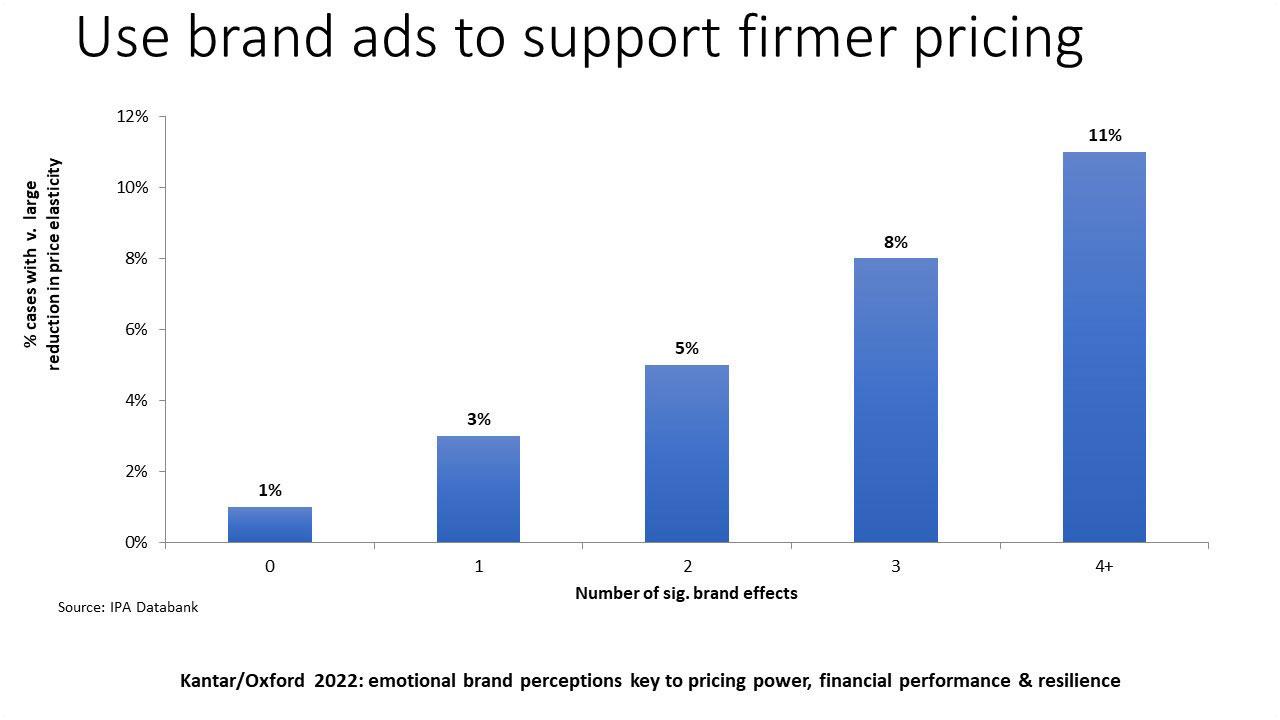

Brand advertising can make people less sensitive to price. The work that Peter Field and I have done with the IPA databank shows that the more that you strengthen brand metrics like awareness, salience, fame, mental availability, and emotional bonding with the brand, the bigger the reduction in price sensitivity, the bigger the reduction in the price elasticity, and the higher the price that you can charge for the product. Only brand advertising can do this.

We've not seen any examples in the data of performance marketing (i.e. sales activation) being used to reduce price sensitivity, increase margins, and support price. In fact, a great deal of performance marketing actually increases price sensitivity. At a time of high inflation and rising costs, a smart move for anyone who can do it would be to shift money from price promotions into brand advertising.

Within that, we find that video advertising, in all its forms, tends to be better than other forms of advertising at reducing price sensitivity and increasing margins. There is something about the emotional power of video that shifts the focus away from rational things, like price and product, to how one feels about a brand and makes price less important in the decision.

Obviously, TV is a very powerful medium for doing that. In fact, nearly all of the cases that we have in the IPA data bank that shows a reduction in price sensitivity involved TV advertising.

Understanding the true value of advertising

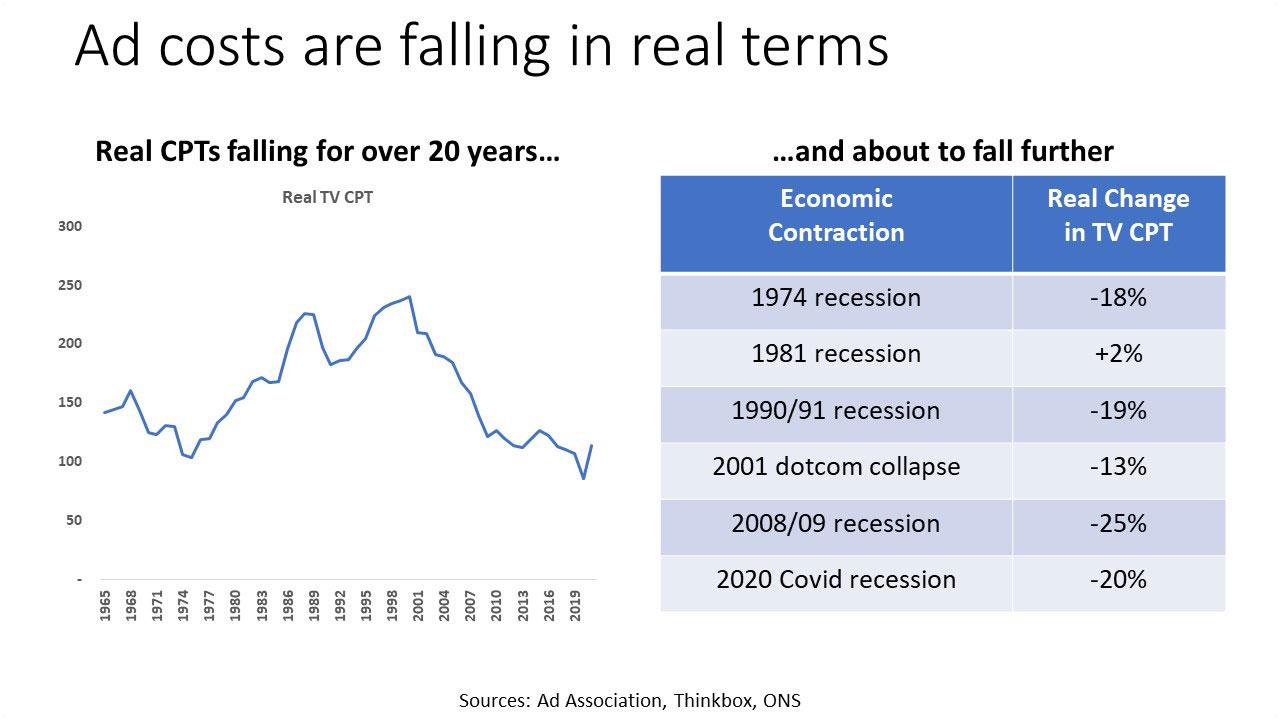

As well as costs rising generally and squeezing margins, you’ll no doubt have heard that advertising costs are rising too. This is true, but we need to think about how those costs are changing in real terms to fully understand what’s actually happening.

The cost of TV advertising has been falling

Taking TV as an example, for the last 20 years or so, its real cost per thousand has been steadily falling. In fact, the cost of reaching people with TV is now at more or less its lowest level since records began.

We’re lucky to have such long-term data for TV, but it will be a similar story for other forms of advertising too – a consequence of the incredible increase in competition we've seen in the advertising marketplace.

So while nominal costs have risen, the real cost of reaching people has been going down, particularly for fixed inventory media, like TV. The good news is that it tends to fall even faster during a recession. We can expect to see the real cost of TV, the real cost of buying eyeballs with TV, fall in 2023.

For those firms whose profit margins are robust and work in sectors that are relatively buoyant – like FMCG – there will be a buying opportunity this year. We saw this with Unilever during the pandemic when TV was incredibly high value for money. They took advantage of it. They piled in and they reaped the rewards. I think something similar is going to happen this year.

There's a chance to exploit TV’s incredible value. Particularly if your competitors are foolish enough to cut their budgets sharply, a chance to buy share of voice and market share cheaply. If you can afford it, this might be the year to exploit cheap share of voice.

Managing risk

Risk is an important factor determining the viability of any investment. If an investment is low risk and you know it's going to pay back, then it's a no-brainer. When investment returns are uncertain, then you have to really ask tough questions about whether it's a good time to invest. This is true of any investment, whether it's a new factory or a new advertising campaign.

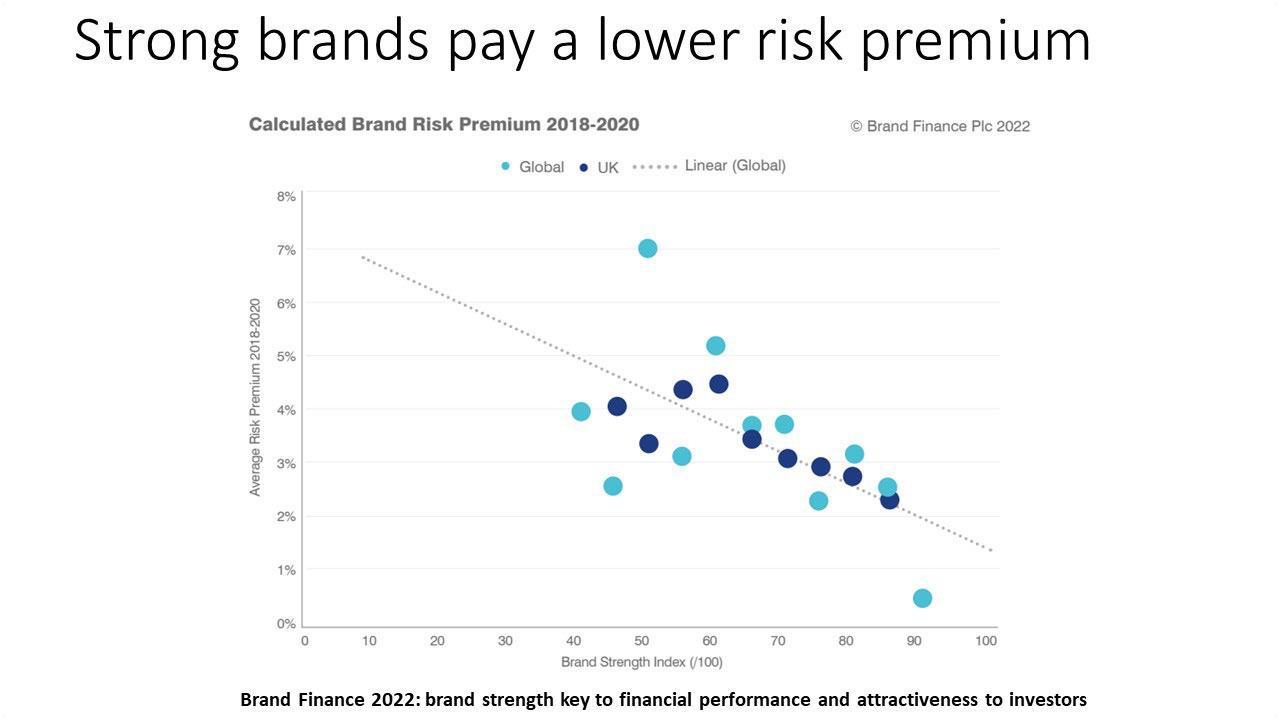

Strong brands find it easier and cheaper to borrow in capital markets

You can do something about the risk involved in your advertising investment. First of all, you can use advertising directly to affect the risk premium that you pay in financial markets.

A study by Brand Finance compared the risk premium that companies pay when they borrow in financial markets with the strength of their brand. They found that the stronger a company's brand, the lower the risk premium they pay.

Again, we see the importance of brand advertising. Not just in order to attract consumers and to maintain your price premium and your margins, but to send a confident signal to investors that you are a strong company and a low risk investment. The City sees advertising too.

This way, you can reduce your capital costs, which makes investing in marketing and other things, like new factories or new products, more viable.

Why attribution modelling is dangerous

If you know with certainty what the payback and what the effect of your marketing and advertising will be, then investment in marketing and advertising becomes a lower risk. This is why good research is vital – understanding what is actually having an effect rather than what looks like it is.

Many marketers find direct attribution, particularly digital attribution, an attractive way to measure effectiveness. Digital attribution gives you an immediate reading on the response to your digital communications. It offers immediate feedback on whether it's working or not.

Digital attribution is fast, direct, cheap, and wrong.

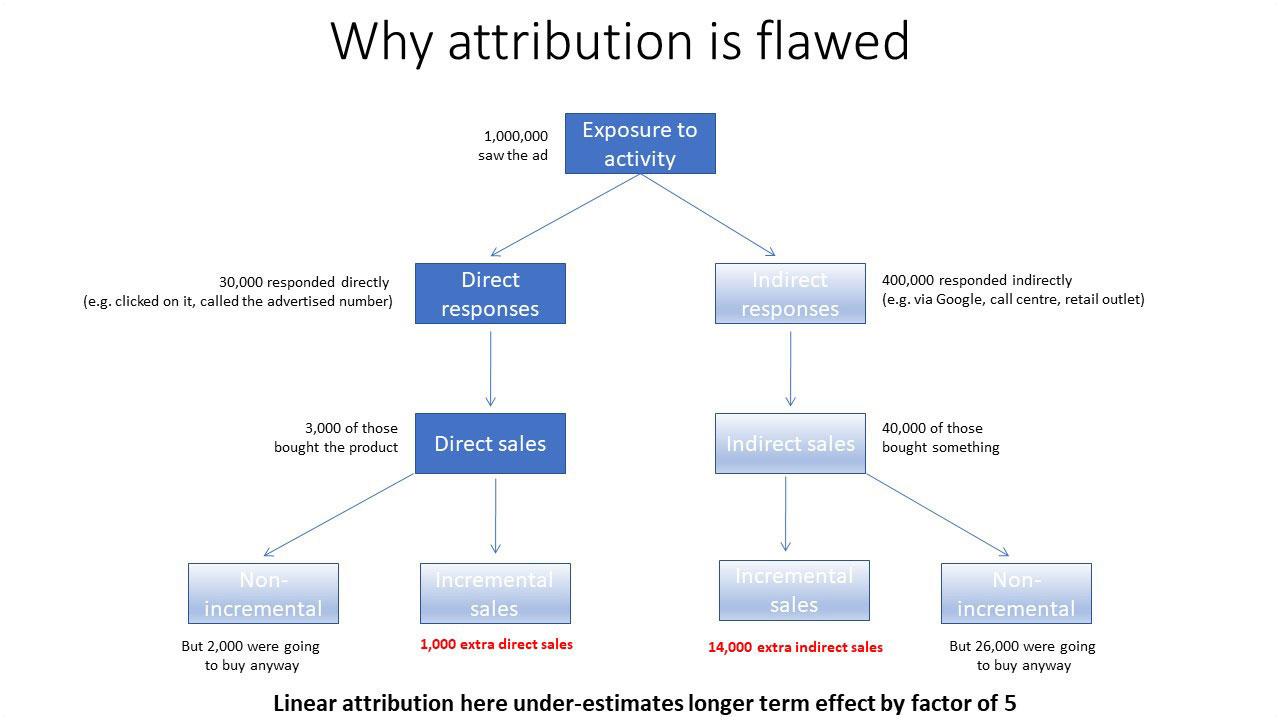

It assumes that every response to a piece of communication – a click on an online video for example – is a consequence of seeing that communication, and so every sale can be attributed to it.

This is wrong because some of these sales come from people who were on their way to buy the product anyway. Econometrics shows that a significant proportion of the sales attributed to online media are misattributed in this way. As a result, simple attribution wildly overestimates direct short-term ad effects.

It also underestimates longer, indirect effects. We know that many people will respond indirectly – they will visit the website a couple of days later, go to a shop, or phone a call centre. They didn't click on the link, but they did respond at some point. This means attribution models tend to underestimate longer term effects, especially for brand ads.

Attribution modelling directs money to the wrong places

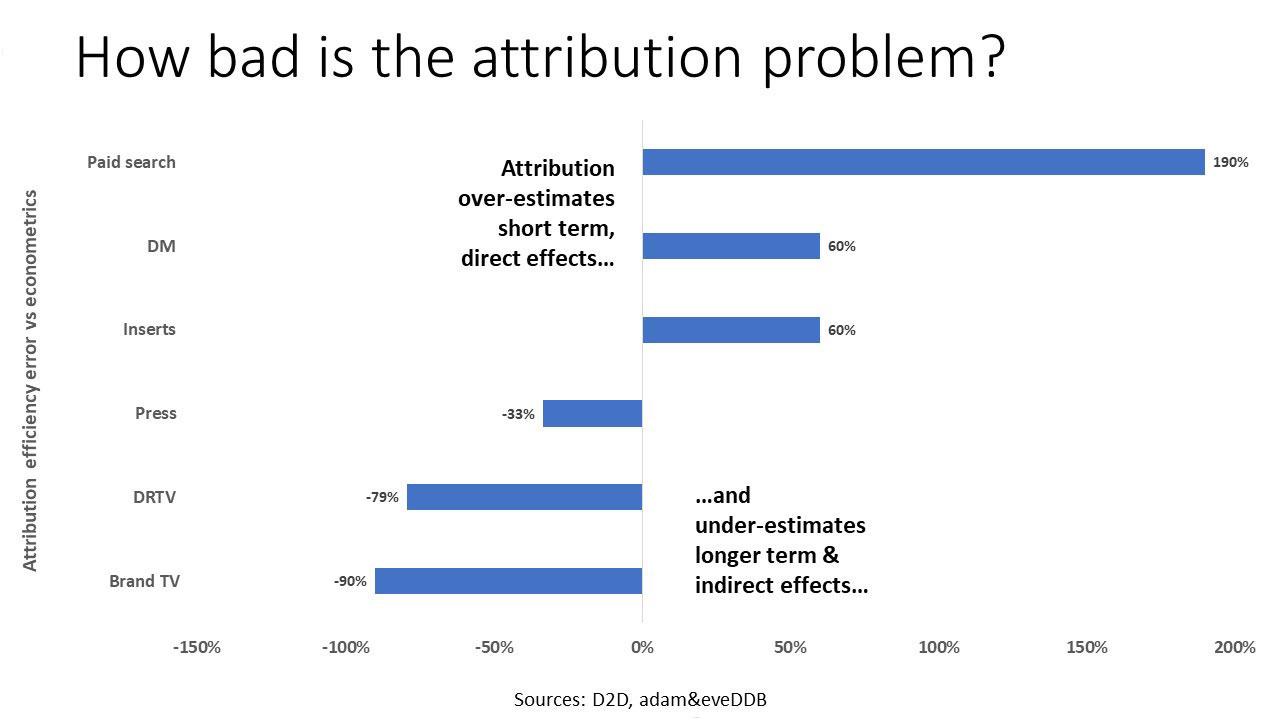

How serious are these measurement errors? In some cases, they are very serious indeed.

Attribution for activities like paid search, direct marketing inserts – ‘performance’ channels in general – hugely overestimate short-term, directive effects. In the case of paid search, it overestimates by nearly 200%.

But for less direct channels – the more brand-oriented channels, more broadcast channels – attribution modelling underestimates their effects just as dramatically. For example, attribution modeling for brand TV advertising underestimates its effectiveness by 90%.

So not only does attribution modelling give a very misleading overall ROI, it directs money to the wrong places. It forces marketers to do too much performance marketing, too much direct marketing, too much sales activation, and too little brand advertising.

Attribution has a role to play. It can tell you about the relative efficiency of two similar direct response channels, for example. But it gives you the wrong numbers when it comes to budget setting. Marketers must supplement attribution modeling with other forms of research, in particular controlled experiments and market mix modeling (AKA econometrics). Those two approaches to measuring ROI are much more reliable for determining your optimum level of investment.

Invest in effectiveness

At a time when costs are rising and margins are under pressure, we're all being asked to do more with less. This is a challenging brief, but there are things you can do.

The first thing is good old-fashioned media planning. Learning to optimize the effectiveness and efficiency of the budget by distributing the money across the right channels and putting it against the right products in the right markets.

The first question you need to ask yourself is, which media are most effective and efficient today?

TV remains the most effective form of advertising

A recent piece of research from Meta looked at the effectiveness of different channels for 3,500 different advertising campaigns in different markets and categories around the world. It found that the most effective media today for short-term performance marketing tend to be digital media, in particular, online video and paid search.

But, crucially, what Meta's research shows is that only about 40% of the payback from advertising comes in the short term from such short-term direct effects. As Peter Field and I have argued for years, the big payback from marketing comes from the longer-term effect of brand advertising and its longer-term effects on sales and profit.

Meta's study found that 60% of the payback comes from these long-term effects. When you add the long-term effects in, you see that the most effective medium in the world today continues to be TV, closely followed by online video.

Video in all its forms tends to be highly effective, particularly if you want to do the brand building that maintains the price sensitivity that increases margins. After that, social media – especially social video – has an important role to play.

Get the creative right

Econometrics consultancy D2D showed that, if you optimize your marketing budget by geography, by product within your portfolio, by variant within your product range, and by advertising medium, you can increase the profit and the payback and the ROI from your advertising by a factor of 12. That's not a small increase.

However, there is one more thing that can give you almost as bigger a multiplier: getting the creative right. D2D estimate that breakthrough creative can increase ROI and profit by a factor of just under 12 – echoing previous findings by Peter Field and I.

At a time when costs are rising, margins are under pressure, and everyone's finding it so tough, it’s never been more important to harness the power of creativity and its core emotional power.

Breakthrough creative is much more likely to produce an emotional response, which gets more attention, more eyeballs, stronger memories, and creates that emotional bonding with a brand which makes people more willing to pay a higher price.

Creativity is more likely to achieve fame, to get people talking about the brand (and talking about your advertising). It doubles the chance that you will get that fame effect which we know can quadruple the efficiency of your budget.

So, use the “abacus economics” of allocating your budget carefully using econometric modeling, but also harness the power of creativity, emotion, and fame. Get a great agency on your side and use that magic to balance the logic of econometrics, because magic plus logic means big profits.

Thinkbox

Thinkbox